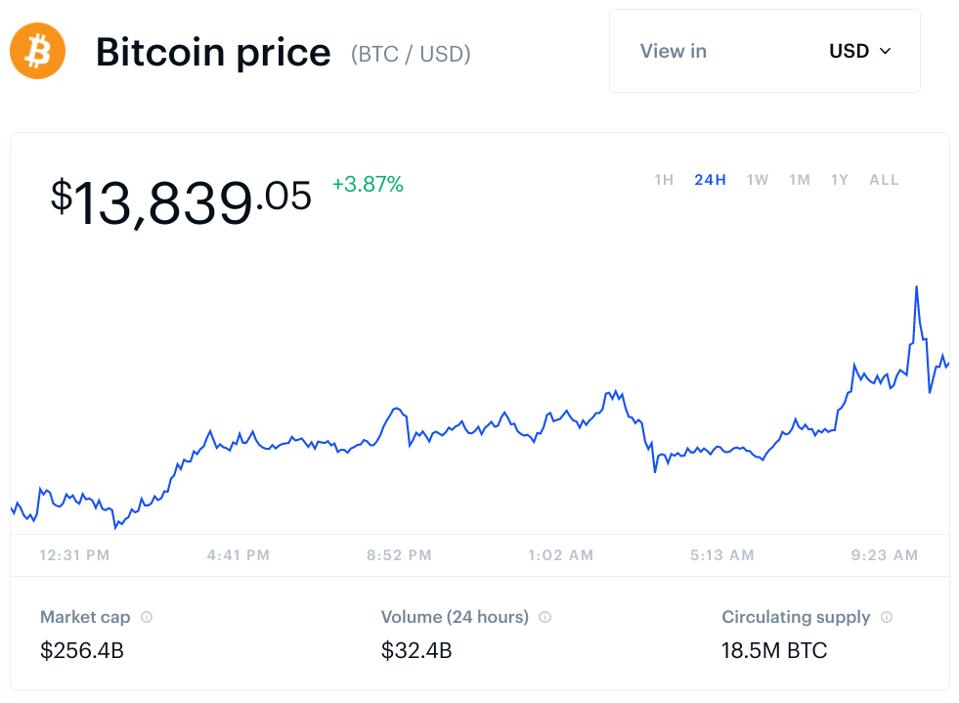

Bitcoin, set to close the month of October with gains of over 25%, has surged again—adding almost 5% in the last 24 hours and pushing it over the psychological $14,000 level for the first time since early 2018.

Bitcoin’s latest rally has boosted the price of other major cryptocurrencies, including ethereum, Ripple’s XRP, chainlink, and litecoin, all up between 3% and 5%.

The bitcoin price surge over $14,000 per bitcoin comes shortly after a number of huge bitcoin transactions—worth more than $100 million—and follows the expiry of $750 million worth of bitcoin options contracts on Friday.

The bitcoin price has climbed through October, pushed on by a raft of positive bitcoin and … [+]

Bitcoin traders and investors have been braced for volatility over the last 24 hours, with high-value bitcoin options contracts—effectively traders betting on what they expect the price of bitcoin to be in the future—expiring. Bullish or bearish trends can be exacerbated by such expiries.

Meanwhile, the bitcoin and cryptocurrency market has been rocked by $100 million worth of bitcoin being removed from two exchanges in the last few hours, the San Francisco-based Coinbase and the Luxembourg-based Bitstamp. A Twitter

The bitcoin price has found support over the last couple of months by a raft of bullish bitcoin news and increasing belief among some investors that bitcoin will serve as a hedge against a tidal wave of inflation they see on the horizon. This has led to bitcoin decoupling from the stock market over the last week or so.

“For most of the pandemic, bitcoin remained correlated with equities,” Andrew Ballinger, Associate at Wave Financial Group, said via email.

The bitcoin price climbed over $14,000 per bitcoin today for the first time since early 2018.

In June, the one-month bitcoin-S&P 500 correlation reached an all time high of 66.2%, according to data from Skew Analytics. Since June, this one-month bitcoin to S&P 500 correlation has been in double digits, for the most part hovering around the 40%-50% range. This month, the double digit positive correlation has been broken.

“I wouldn’t be fully honest if I said I didn’t believe a major downturn in equities would have no effect on the still nascent digital asset economy, but I think this return to single digit and potentially negative correlation is a step in the right direction for those who believe in bitcoin’s store of value thesis,” Ballinger added.

“With continued uncertainty surrounding the economic recovery, investors may turn to digital currencies over equities, and test the ‘digital gold’ thesis of bitcoin further.”