Bitcoin and cryptocurrency investors have taken a beating this week, with $50 billion wiped from the combined value of the world’s cryptocurrencies.

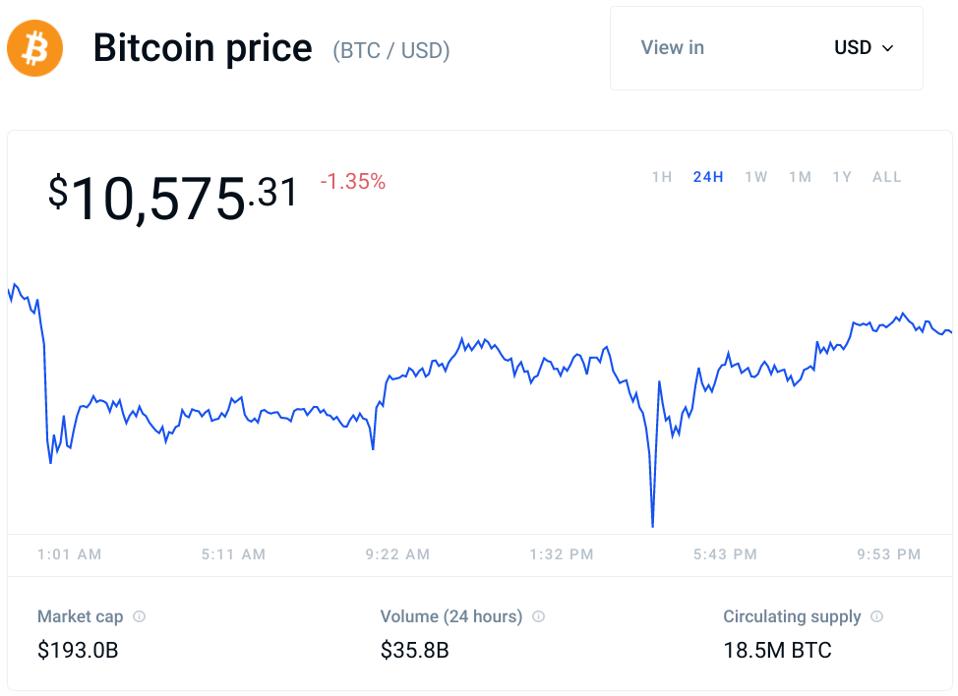

The bitcoin price, which touched $12,000 per bitcoin earlier this week, dropped to just under $10,000 before rebounding to around $10,500, mirroring the ups and downs of the U.S. stock market.

Ahead of bitcoin’s wild price swings, former hedge fund billionaire-turned crypto investor, Michael Novogratz, warned crypto’s “speculative frenzy” was getting carried away.

The bitcoin price has swung wildly this week, losing around 10% of its value since Monday.

“I’m trying to stay as optimistic and bullish as I can on crypto, because it’s really early in the cycle, but give the warning that there are other things in the markets that have me worried,” Novogratz told financial newswire Bloomberg earlier this week, pointing to “too many markings of what a top looks like.”

Novogratz, the founder and chief executive of crypto merchant bank Galaxy Digital, named electric car-maker Tesla

Alongside Tesla’s stimulus-fueled rally, plucky investors have poured billions of dollars into new cryptocurrency projects in recent months, with many decentralized finance (DeFi) tokens promising sky-high rewards.

Many tokens tied to DeFi platforms crashed over the last couple of days, with the flavor-of-the-week, Sushiswap, losing more than half its value.

“High-flying DeFi coins took the biggest hit during yesterday’s sell-off with many being down 20% or more versus bitcoin over the 24-hour period,” Tim Plakas of Galaxy Digital Trading said via email.

“It was almost a mirror image of what we witnessed in the equity markets yesterday, with many popular tech names getting hit hard as sentiment shifted.”

The bitcoin price has bounced wildly this week as stocks retreated from all-time highs, led lower by … [+]

Despite what he calls a “speculative frenzy” emerging over recent months, Novogratz is still bullish on bitcoin in the long-term.

“I’m positive that in ten years, the ecosystem around bitcoin and cryptocurrencies, the whole space, is going to be multiple times bigger than it is today,” said Novogratz, who describes the emerging crypto space as “a sandbox” that should be put in the “broad venture capital bucket.”

“Cryptocurrency is here for good,” he added. “I couldn’t say that in 2017, or 2018, but that sentence comes with an exclamation point starting this year.”