Bitcoin’s decline from the $ 11,000 resistance was hard this time, and altcoin prices were also pulled down. DeFi coins UNI YFI LEND SNX continue to take heavy blows following the decline experienced by Ethereum with their decline.

Ethereum has also been the leading altcoin in the cryptocurrency community, leading the rallies for alcoins in the past. This leadership was valid for uptrends as well as downtrends. As we’ve seen recently, Ethereum fell more than 10% in one week to $ 336.

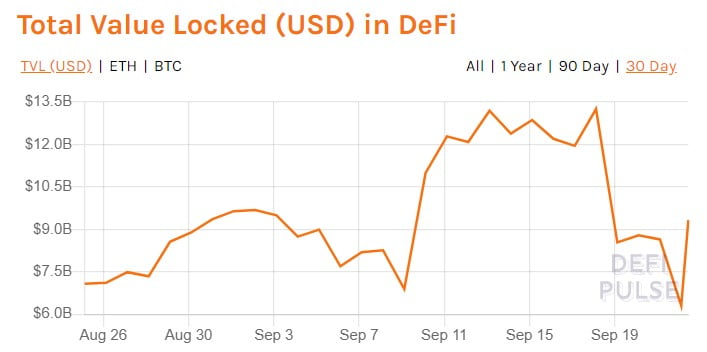

With the weakening shown by Ethereum, it has also created a certain selling pressure on ETH-based DeFi tokens, which have blown like a wind in recent months. As a result, popular DeFi coins; The decline was inevitable for Uniswap (UNI), yearn.finance (YFI), Synthetix Network Token (SNX) and Aave (LEND).

Why is DeFi in Distress?

The crypto money analyst known as Theta Seek on Twitter summarized the simple reasons for this decline in a series of tweets he published.

- The decentralized finance (DeFi) world can be a difficult industry for investors to hold onto without sweat in crypto money or financial technology. In fact, it is known that many leading investors, including large holding holders, suffer from many reasons such as software errors in DeFi platforms or misuse of smart contracts.

- The main Ethereum network and DeFi ecosystem may be slowing down. With increasing interest and ensuing transaction fees; The pending low-cost transactions inflate the system play an important role in this.

- Especially with the high profit margins offered by DeFi platforms, the “money grabbing” race between investors in the crypto money world may lead to the loss of the legitimacy and attractiveness of the system.

- In the Ethereum DeFi space, “tight-management” regulations can be made. Just last week, American Etherem regulators announced that they were noticing the distortions in the DEFI area. After a major bug or hack, ETH regulators can impose severe sanctions on DeFi.

Uniswap (UNI)

Uniswap, which dropped like a bomb in the cryptocurrency world, ranked 7th among DeFi coins with a market value of $ 475 million, even before a week. Listed by many important exchanges as it appeared, UNI had increased its price to $ 8.40 right after its release. However, the current UNI price is $ 3.96, with a depreciation of over 50%.

Yearn.finance (YFI)

YFI, which is currently traded at 23 thousand 231 dollars, had managed to increase its price to 43 thousand dollars just 10 days ago. After this success, YFI surprised its investors with a 41.3% decline in the last 7 days. The total value of YFI token, which is currently ranked 4th in the DeFi sector by market value, is approximately $ 700 million.

Aave (LEND)

One of the most important factors that make the DeFi world so attractive, Aave’s own coin LEND, which is one of the most important platforms for the yield farming model, has dropped by more than 32% in the last 7 days. The LEND, with a market value of $ 584 million, is currently being bought and sold for $ 0.46.

Synthetix Network Token (SNX)

SNX, which raised its price to $ 7.84 in early September, is now being traded at $ 3.74, with a 52% crash. With a market value of about $ 460 million, SNX is one of the losers of the last week. DeFi coin, with a 24-hour volume of over $ 100 million, has lost 27% in the last 7 days.