Source: R.Danyliuk – Shutterstock

- Stephen S. Roach predicts a devaluation of the USD by 35%, although Bitcoin could only slightly benefit from this.

- Following the recent price trend of Bitcoin, Willy Woo is predicting a decoupling of Bitcoin from the traditional market.

The former chairman of Morgan Stanley Asia, Stephen S. Roach, recently made a shocking prediction about the future of the US dollar in an op-ed. Roach explained that the dollar fell by 4.3% in the last quarter of 2020. By the end of 2021, he believes the currency could depreciate by 35%. The expert called the USD “the most overvalued currency in the world” and examined the implications for Bitcoin from this.

Roach attributes the devaluation of the US dollar to 3 main reasons. First is the loss of the ability of the US population to save. Roach believes that the United States is in a phase of “rapid economic decline”, exacerbated by the COVID-19 pandemic. According to the expert, the national net savings ratio is negative at -1% in the second quarter of this year and shows a decline of 3.9% in the first quarter. The last time similar figures were recorded was in 1947 and the expert expects this figure to deteriorate due to the expiry of unemployment benefits in the country.

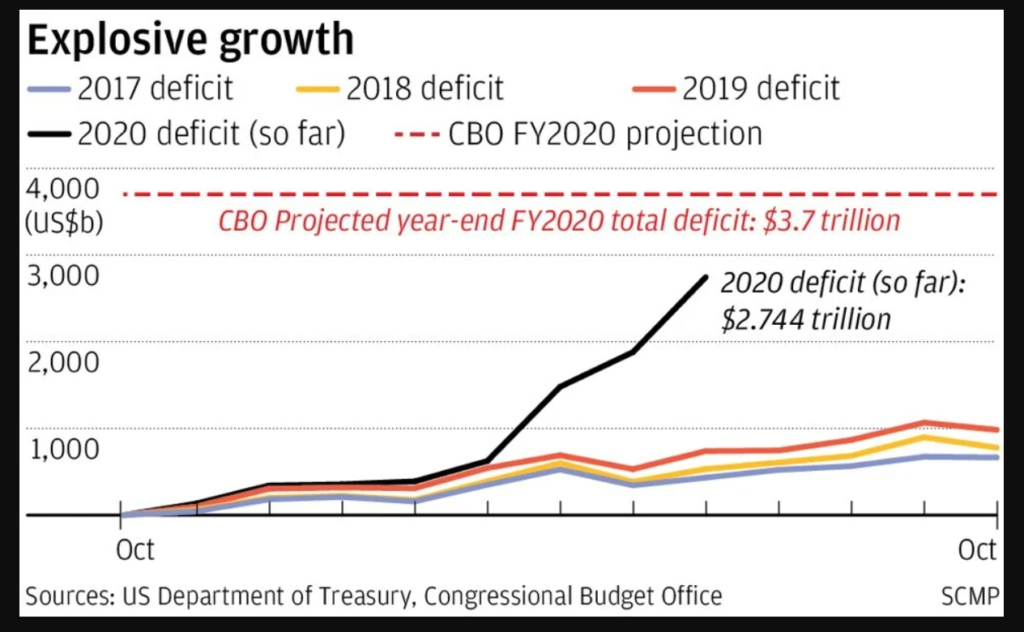

In conjunction with this, Roach claims the annualized U.S. federal deficit stands at $5.7 trillion in the second quarter of 2020. In that period, the deficit increased by more than $1 trillion in order to afford the injection of money into economic aid for the U.S. population. In total, the U.S. deficit accumulates $2.744 trillion in 2020, as shown below, a figure unprecedented in the last 3 years.

Source: https://www.scmp.com/comment/opinion/article/3103197/why-us-dollar-only-going-fall-faster-and-harder

The expert also points out that the Fed’s change in monetary policy has put negative pressure on the dollar. The institution has adopted a strategy that favors “average inflation” and, therefore, will keep interest rates at zero for a long period, according to the expert. This rules out an “important option,” Roach said, to mitigate the dollar’s decline. Furthermore, Roach adds:

Driven by the explosive surge in the federal budget deficit this year and in the next, the collapse of domestic savings and the current-account implosion should unfold at near-lightning speed.

Bitcoin decouples from traditional market

However, Roach’s predictions could be even fulfilled at a faster pace. House Democrats unveiled yesterday a new $2.2 trillion stimulus plan that includes reviving the $600 federal unemployment benefits until the end of January and additional stimulus checks.

According to Roach, Bitcoin and the crypto market will benefit from the economic situation in the U.S., especially from the fall of the dollar. However, he expects Bitcoin and the crypto market are still too small to “absorb the major adjustments” in world foreign-exchange markets.

In that sense, the crypto market did not react positively to the new economic aid announcement. At the time of publication, Bitcoin is moving sideways (-0.92%) and is trading at $10,763. In the traditional market the news did have a strong impact. The S&P 500 index rose by almost 2% after the announcement; Gold rose 1.06%.

In this sense, several analysts have stated that Bitcoin has begun to decouple from the traditional market. Analyst Willy Woo has commented over the last few weeks that a separation of Bitcoin from the traditional market is imminent. Woo believes that Bitcoin is adopting its own “Curve of Holders”. These will be made up of the inhabitants of countries with high inflation rates and the new generations, as Woo asserted:

At a certain point you’re going to get a HODLer investor squeeze on the whipsaw game, and the price teleports upwards to a new technical setup and a new “correlation narrative”.

There’s your de-coupling.