After the XRP price reached our short-term bullish target of ±$0.35, it is now on its way to reach our correction target of ±$0.2!

In our last XRP Price Forecast on the 27th of August we wrote:

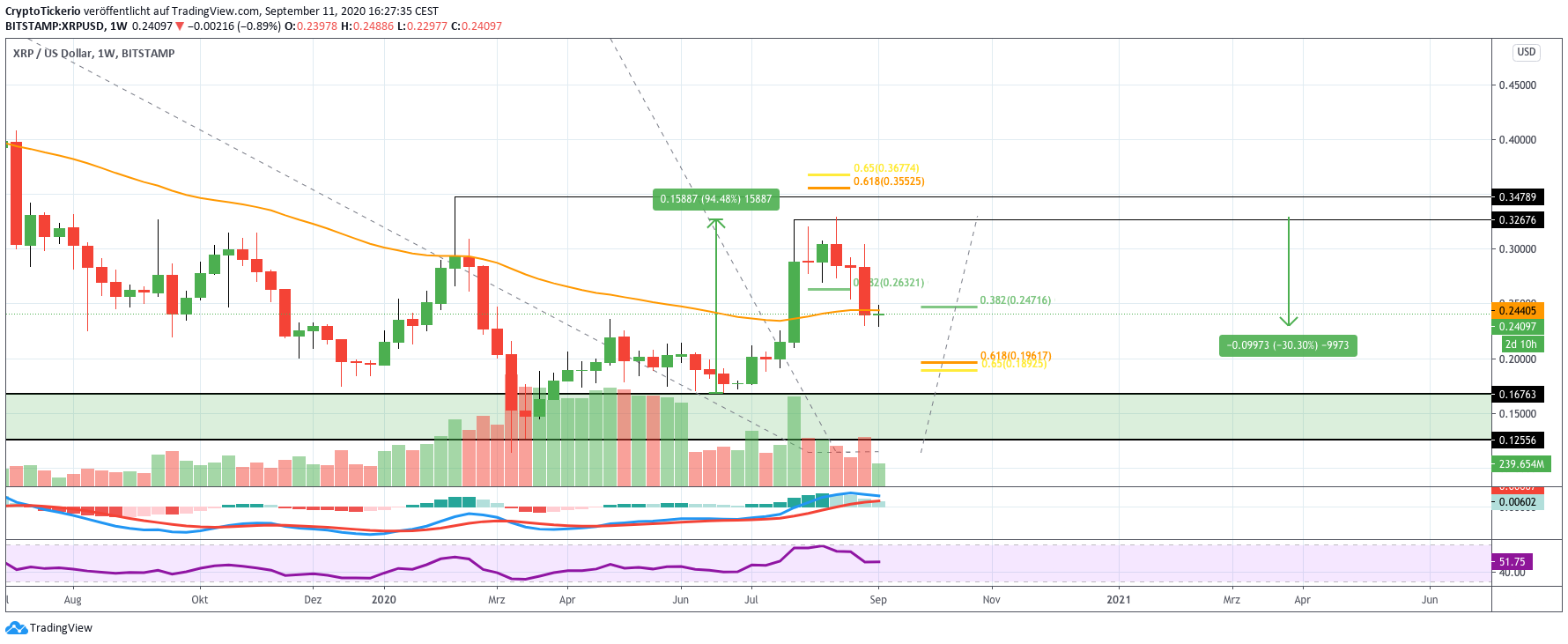

„ In the weekly chart, the months long downwards trend of XRP becomes apparent. Ripple’s price formed a “lower high”, confirming the bear trend. Nevertheless, the enormous increase in the trading volume is to be viewed bullishly. But still, the MACD’s histogram is having a bearish development here as well. Should the 0.382 Fib support not hold at ±$0.2631, XRP’s price could return all the way back to the golden ratio support at ±$0.2. “

Ripple Price Forecast – On the way to the golden ratio at ±$0.2?

Short-term the XRP price found support at the 0.382 Fib level at ±$0.2631, but a few days later the price bearishly broke through the support. Currently the XRP price finds support at the 200-Daily-EMA at $0.23415, should this support bearishly fail as well, the XRP price would fall back to the golden ratio resistance at $0.2. Should this level also fail, XRP would find horizontal support between $0.125 – $0.167.

Looking at the MACD, whose histogram started developing bullishly again, and whose lines could be about to have a bullish crossover soon, the XRP price could soon have a strong upward correction. At the latest, the RSI should have reached oversold regions once again after reaching the golden ratio, which could lead to the XRP price having a strong bounce upwards.

Ripple Price Forecast – Things look less positive in the weekly chart!

The weekly chart however showcases the bearish lookout awaiting XRP in the middle-term. The histogram has had a bearish development for several weeks, while the MACD lines stand right before a bearish crossover. Additionally, the XRP price seems to be up for a bearish rejection at the 50-Weekly-EMA at $0.244.

The XRP price has already fallen by 30.30%, since reaching its local high around $0.33. The XRP price could soon fall lower, to find support at the golden ratio at ±$0.2.

However, because of the bullish daily charts, XRP could in the short-term rise to the 0.382 Fib level at $0.26321.

Significant resistance still lies ahead of XRP between $0.32767 – $0.3677.

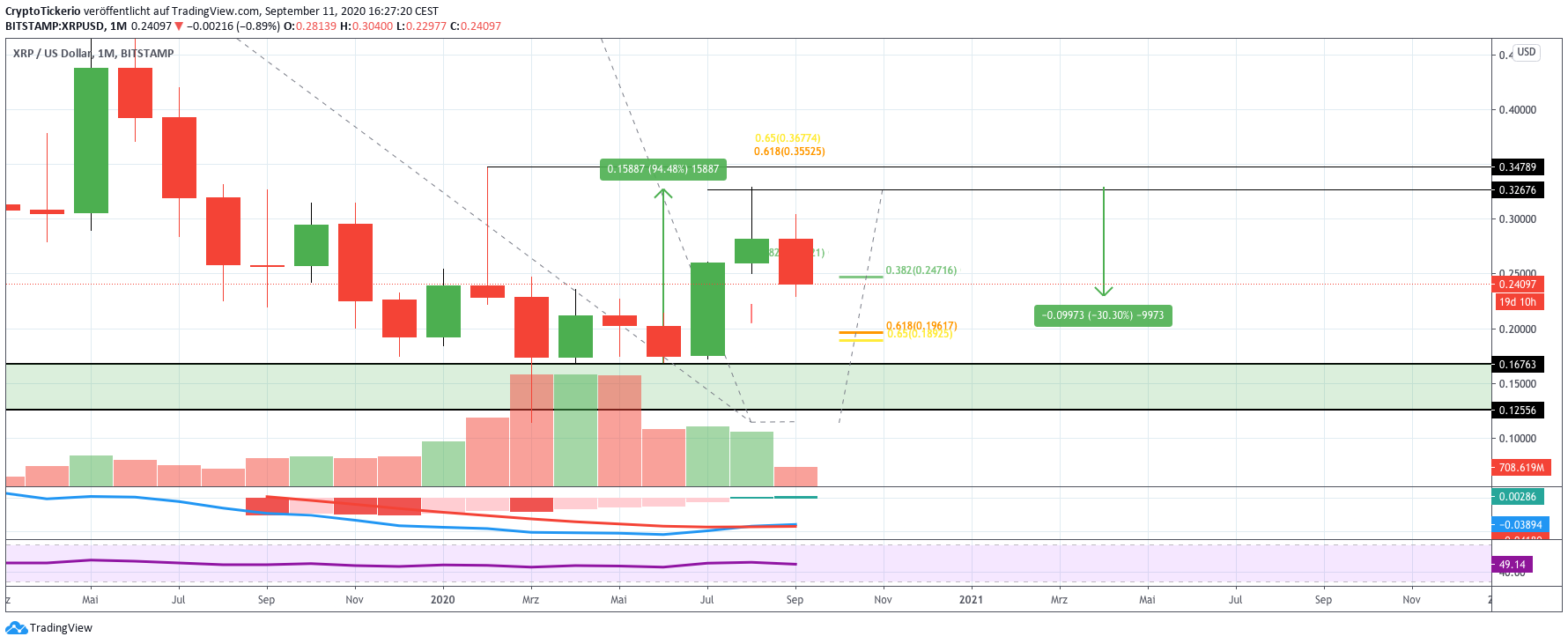

XRP Price Forecast – Monthly MACD shows an upward trend!

The MACD lines had a bullish crossover on the monthly chart, and the histogram keeps on bullishly ticking higher. Nevertheless, the current developments hint at a continuation of the correction.

But should the Bitcoin price rise, it would give a push to the XRP price as well! Therefore, it is essential to keep an eye on the Bitcoin charts, and watch whether BTC can hold the important $10,000 support or not!

A possible scenario could be that the XRP price falls down to the golden ratio at ±$0.2, have a strong bounce there and move up toward the resistance between $0.32767 – $0.3677 once more in order to break it.

The chances to establish a high above $0.33 during the ongoing year are still there!

XRP Price Forecast – How is it looking for the XRP/BTC pair?

The XRP price is struggling against Bitcoin with the significcant resistance of the 200-Daily-EMA at 0.0000244 BTC, which lies right below the 0.382 Fib level at ±0.00002473 BTC. XRP currently finds support at the golden ratio at ±0.00002258 BTC.

Otherwise, should XRP fall through the golden ratio at ±0.00002258 BTC, significant support would await it between 0.00001277 – 0.00001875 BTC!

Click here to join our trading channel

Best Regards and successful trades

Konstantin

In order to support and motivate the CryptoTicker team, especially in times of Corona, to continue to deliver good content, we would like to ask you to donate a small amount. Independent journalism can only survive if we stick together as a society. Thank you

Nexo – Your Crypto Banking Account

Instant Crypto Credit Lines™ from only 5.9% APR. Earn up to 8% interest per year on your Stablecoins, USD, EUR & GBP. $100 million custodial insurance.

Ad

This post may contain promotional links that help us fund the site. When you click on the links, we receive a commission – but the prices do not change for you! 🙂

Disclaimer: The authors of this website may have invested in crypto currencies themselves. They are not financial advisors and only express their opinions. Anyone considering investing in crypto currencies should be well informed about these high-risk assets.

Trading with financial products, especially with CFDs involves a high level of risk and is therefore not suitable for security-conscious investors. CFDs are complex instruments and carry a high risk of losing money quickly through leverage. Be aware that most private Investors lose money, if they decide to trade CFDs. Any type of trading and speculation in financial products that can produce an unusually high return is also associated with increased risk to lose money. Note that past gains are no guarantee of positive results in the future.

You might also like