We have a very action-packed week ahead with a great deal of important economic indicators coming out. Some of the most pressing data points include:

Tuesday – Consumer confidence (killed it 101.8 vs. expected 89.2), coupled with Fed speeches from various members.

Wednesday – ADP non-farm employment, Q2 QoQ GDP, pending home sales, crude oil inventories, as well as more Fed speak from Federal Reserve members.

Thursday – Inflation data, initial jobless claims, personal spending, key manufacturing data, as well as more speak from Fed members.

Friday – The all-important non-farm payrolls, unemployment rate, and consumer sentiment.

I view this as one of the most crucial weeks markets have seen in some time. There is a lot of uncertainty right now due to various factors such as the continuous spread of the coronavirus, the upcoming Presidential election, fiscal stimulus, further Fed action, etc.

Therefore, the market will likely pay close attention to the upcoming economic data. Given that many markets are trading around crucial technical levels, positive economic data along with constructive Fed talk could provide the support markets need to move higher from current levels.

Let Us Look at Some Technical Setups

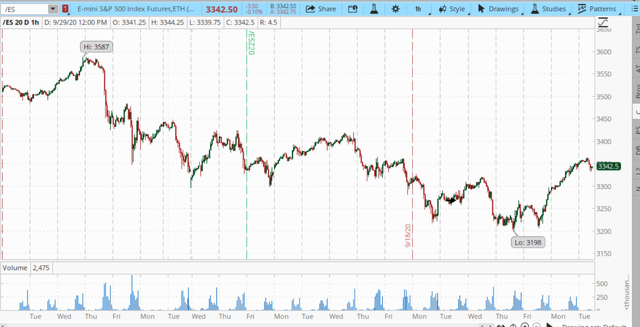

S&P 500/SPX (SP500) Futures

Source: Think or Swim, Ameritrade

Source: Think or Swim, Ameritrade

At the time of writing this article, the SPX futures are essentially flat. However, we are very close to an extremely important resistance level at 3,360. If SPX can break out above this level, 3,420 resistance is next. If 3,420 is cleared, we can probably expect the current uptrend to continue. I also like that SPX appears to have put in a double bottom around the critical 3,200 support level, which is roughly an 11% correction from recent ATHs.

However, as we are in an uncertain period, we should also consider possible downside as well going forward. So, the initial support level from here is 3,300, but I consider this “soft” support, meaning it could get penetrated quite easily. Next is firmer support at 3,200, but if the 3,200 level gets taken out this time, I expect the SPX to fall all the way back down to its firm support level at 3,000. This would represent a correction of roughly 16.3% from recent ATHs.

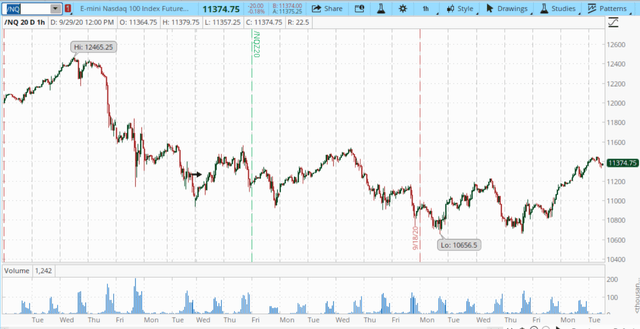

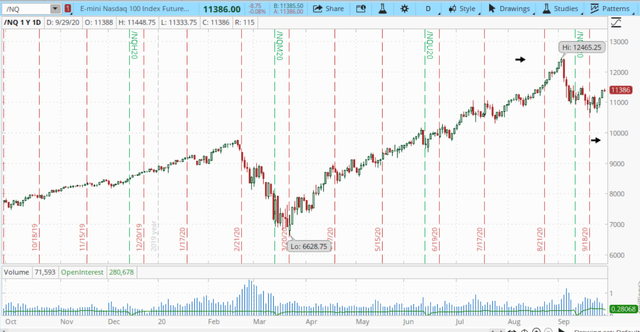

Let’s Discuss the Nasdaq (futures) Next

We see a somewhat similar image here as in the SPX (futures). Key resistance to get above here is the 11,550-11,600 level. We also see a possible double bottom around the 10,650 level, bringing the Nasdaq’s total correction (peak to trough) to roughly 15%, which is notable. Nevertheless, there is the possibility of further downside, so let us discuss some support/stop-out levels. First real support I see is around 11,200, then there is some support around 11,000, but if this level breaks down decisively, the Nasdaq could be headed back down to around 10,650 support or lower.

We see a somewhat similar image here as in the SPX (futures). Key resistance to get above here is the 11,550-11,600 level. We also see a possible double bottom around the 10,650 level, bringing the Nasdaq’s total correction (peak to trough) to roughly 15%, which is notable. Nevertheless, there is the possibility of further downside, so let us discuss some support/stop-out levels. First real support I see is around 11,200, then there is some support around 11,000, but if this level breaks down decisively, the Nasdaq could be headed back down to around 10,650 support or lower.

In a worst-case scenario, the Nasdaq (futures) could fall to around 10,000-9,500. Naturally, a lot of fundamental factors have to go wrong for this kind of decline to materialize, but it should not be ruled out at this time. A fall to 10,000 would represent a “correction” of about 20%, and if we fall back to 9,500, it would be a fall of around 24% from recent ATHs. A note to make is that a fall to the midpoint of this area would bring the Nasdaq back down to its pre-COVID highs.

What about Gold and Silver?

What about Gold and Silver?

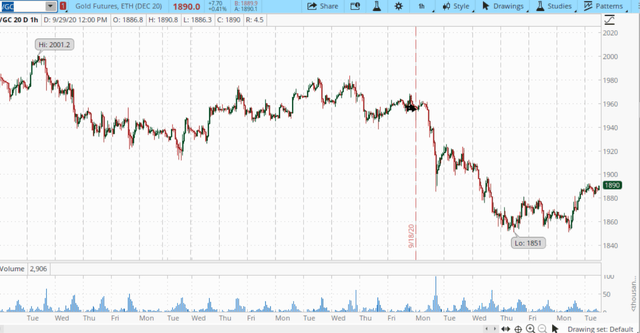

Gold futures

Gold appears relatively stable, even constructive here after bouncing off the $1,850 support. Moreover, we appear to have a possible W-shape bottom developing after a correction of 11.5% from recent ATHs. However, it is critical for gold to make a move above $1,900 and then $1,920 to break out of the current downward trend.

Gold appears relatively stable, even constructive here after bouncing off the $1,850 support. Moreover, we appear to have a possible W-shape bottom developing after a correction of 11.5% from recent ATHs. However, it is critical for gold to make a move above $1,900 and then $1,920 to break out of the current downward trend.

With a couple of trillion dollars in freshly-minted stimulus likely on its way, gold will probably move higher in my view. After $1,920 it will be imperative to get above the $1,940-$1,960 resistance level, following which we will likely see a move towards new ATHs. On the other hand, if $1,850 support gives out, the $1,800 support level is likely next.

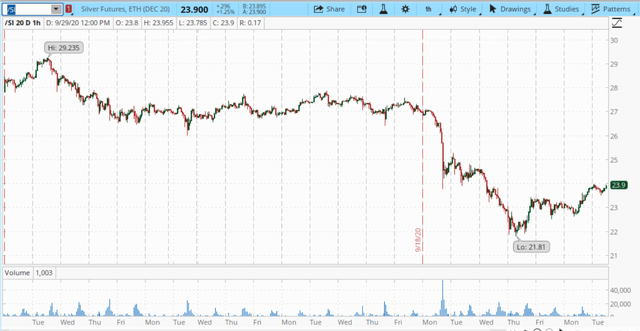

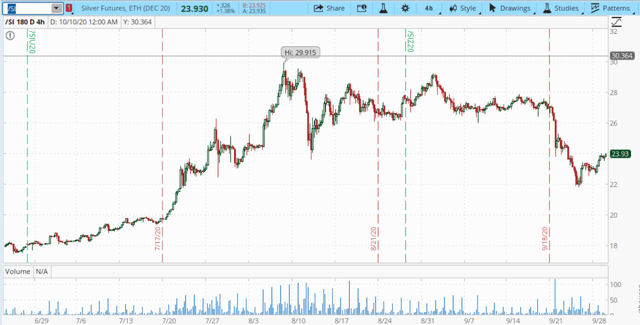

Silver futures

Silver is looking quite constructive here, and is likely going to make a move towards key $25-$25.50 resistance level next. After that, we can probably expect a run at $28, then $30.

Silver is looking quite constructive here, and is likely going to make a move towards key $25-$25.50 resistance level next. After that, we can probably expect a run at $28, then $30.

To the downside, initial “soft” support is at $23, and firm support is at around $22. However, if silver breaks below $22, we are likely looking at further downside to $20, and possibly lower after that. This scenario does not seem likely in my view, but it is plausible.

To the downside, initial “soft” support is at $23, and firm support is at around $22. However, if silver breaks below $22, we are likely looking at further downside to $20, and possibly lower after that. This scenario does not seem likely in my view, but it is plausible.

Thus far, silver’s “correction” has been approximately 27% from peak to trough. A move down to the $20 level will equate to a drop of about 33% from recent highs (roughly $30).

A Bit About Bitcoin (BTC-USD)

Bitcoin remains in its intermediate term trading range of $10,000-$11,000. Now, I am constructive on Bitcoin and the blockchain enterprise market in general due to the multiple applications, and services top alt-coins can continue to provide going forward. However, for now, we see that Bitcoin’s price action has been largely correlated to the S&P 500, as well as gold/GSMs (gold, silver, miners).

In fact, stocks, GSMs, BTC/ALTs have been moving largely in tandem lately. It seems that everyone wants more easing, and if the markets don’t get what they want, we may see a mini-repeat of the mid-March madness. Heightened volatility environments cause all sorts of negative issues such as margin calls, fear, panic selling, etc. Due to the abnormally volatile environment we are in right now price action in key markets seems to be more correlated than usual. A decoupling of this phenomenon should occur eventually, but not likely until we see a decline in volatility across the board.

Key levels to watch in Bitcoin for now are $11,000-$11,100, $10,500, and $10,000-$9,900. Preferably we will see a clean break above 11,100 resistance in upcoming sessions. This will create a very bullish setup to go for $12,000 and possibly higher. However, a fall below $10,500 will likely press BTC back down to around $10,000, and if $9,900 breaks, BTC could retrace back to roughly $8,800-$9,000 support.

The Bottom Line

Indeed, this is a very crucial week for markets. Not only is it filled with extremely important economic data points, but we also have numerous Fed members speaking on the state of the economy as well as other “matters.” Technically, key markets appear relatively constructive after their recent selloffs. Nevertheless, we see that many markets remain around crucial technical levels.

There is a lot of uncertainty in general, which is likely the main cause keeping markets from moving higher. Thus, we need some positive news flow regarding fiscal stimulus, economic data, further Fed support, news on the coronavirus vaccine front, to provide markets with the boost that they need to reverse their negative momentum rather than accelerate it.

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

Disclosure: I am/we are long BTC-USD, GOLD, SILVER. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.