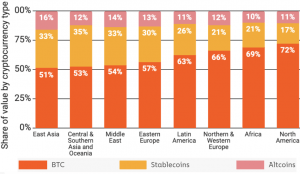

Bitcoin (BTC), the first and largest cryptocurrency, has the strongest positions among crypto users in North America, while stablecoins and altcoins get more attention in Asia, a new report from crypto analysis firm Chainalysis showed.

According to the report, BTC made up 72% of the crypto transfer value in North America, where stablecoins only made up 17%, and other altcoins 11% of the total value. By contrast, bitcoin made up 51% of the value of crypto transfers in East Asia, with stablecoins here taking 33%, and other altcoins 16% of the market.

Share of regional activity by cryptoasset type

In explaining the difference between West and East, Chainalysis said that East Asia is “dominated by professional traders.” Further, it noted that these traders tend to “engage in more speculative trading of a wider variety of assets” compared to their North American colleagues, who instead “tend to focus more on bitcoin and hold for longer.”

Regarding Central and Southern Asia, however, the report said that it is the higher level of remittances from abroad, as well as some capital flight from local currencies such as the volatile Indian rupee, that is driving demand for US dollar-pegged stablecoins in particular.

“Whereas exchanging rupees for US dollars directly is difficult due to local regulations, stablecoins like tether give users an easy way to get exposure to the dollar and lock in savings,” the report said.

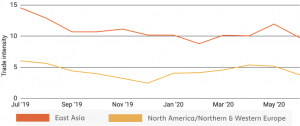

Meanwhile, it added that traders based in East Asia appear to trade more frequently than those in the West, with Asia-focused exchanges showing a bitcoin trade intensity “between 1.4x and 3.8x higher than those catering to North America.”

And while this may be attributed to the higher share of professional crypto traders in the East Asian market, Chainalysis also noted that buy-and-hold is a more used strategy in North America and Northern & Western Europe. As a result, crypto addresses based in the region also have “a much larger collective balance than East Asia-based addresses,” the report said.

BTC trade intensity in East Asia versus North America and Northern & Western Europe

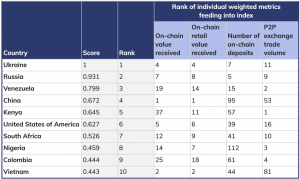

Further, it also pointed to its Global Crypto Adoption Index, which ranks “grassroots adoption by everyday users,” saying that crypto is now “truly global,” with particularly high grassroots activity in developing countries where peer-to-peer (P2P) platforms play an essential role in crypto adoption.

“The top four countries for P2P cryptocurrency activity weighted by number of internet users and [purchasing power parity] per capita all appear in the Global Crypto Adoption Index’s top ten, and all four are developing countries,” Chainalysis said.

As reported, the top three spots of the index were taken by Ukraine, Russia, and Venezuela, which were deemed to be the countries where the most residents have moved the biggest share of their financial activity to cryptocurrency.

___

Learn more: Asia Dominates Crypto, But Here’s Why That Could Soon Change