Marie Tatibouet is the Chief Marketing Officer at crypto exchange Gate.io.

______

It was a quantum leap for Bitcoin (BTC) when its block size got close to 1 MB in 2017. However, the BTC blockchain is still only allowed to tackle seven transactions per second, many times fewer than the actual demand. The issue has become even more prominent in today’s world that runs on instant gratification.

Despite blockchain technology’s promising impact, especially in the financial and banking sectors, the scalability trilemma, as Vitalik Buterin, Ethereum (ETH) co-founder) calls it, is real. More precisely, this means that only two out of the three properties of scalability, security, and decentralization can be simultaneously achieved; any improvement in one of these aspects negatively impacts at least one of the other two.

The scalability of public blockchains is vital for the overall industry if they look at the technology to address the existing challenges in the space. As a result, blockchain communities and organizations worldwide are trying their best to create scalable solutions to support a large number of nodes, and it has been a challenge, to say the least. Many open-source blockchain projects have been dealing with this issue. It was reported that over 26,000 open-source blockchain projects were created on GitHub in 2016. However, just 8% of these projects were actively maintained in 2017.

The article below explores and analyzes two major capacity expansion technologies – state channels and sidechains. It also compares the Lightning Network to Plasma, the two techniques that support communication between various transaction batches.

From layer zero to layer one to layer two

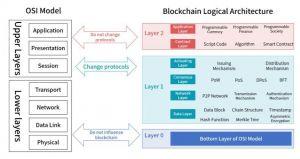

A blockchain architecture consists of three layers – underlying (Layer 0), on-chain (Layer 1), and off-chain (Layer 2); all of them are based on the OSI (Open Systems Interconnection) model structure, from base to high-level protocols.

Layer 0 could be considered the physical part of blockchain technology. However, when it comes to more abstract concepts, the main focus is on Layer 1, which involves network, data, and incentives. Layer 2 relates to contracts and applications – it is precisely within Layer 2 that the scalability challenge arises.

Present-day scaling solutions – state channels and sidechains

Finding a path where scalability walks alongside a secure and decentralized technology to alleviate trading congestion is difficult. However, it is not impossible. So far, investigation and research in the blockchain industry have brought two possible solutions with different applications within them: state channels and sidechains, and both have scalability related issues to address.

State channels

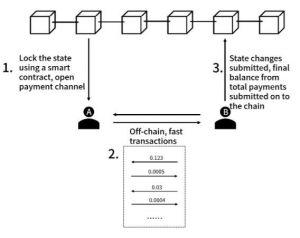

State Channels bring a temporary off-chain peer-to-peer trading route outside the native blockchain. Once trading finishes between the two parties or reaches its expiration date, or if any of the parties synchronize the data (initial and final transactions) to the primary chain, the results get recorded back onto the main blockchain. In this manner, the block confirmation process speeds up, and users’ privacy is well protected.

Nevertheless, the inconvenience of both parties having to be online simultaneously to avoid the risk of deceit creates limitations for this particular scaling solution. While state channels have strong privacy properties, the need for 100% availability of all participants could be considered a disadvantage in the long run.

Lightning network

The Lightning Network is a state channel-based application and a possible solution to the Bitcoin blockchain’s scalability challenge. It takes care of part of the processing to offload and outsource work from previous layers, which means that not all transactions have to occur on the native blockchain. Miners only need to package and upload the initial and final transactions recorded in the Lightning chain. By setting an off-chain channel to trade, this solution is meant to handle up to 50,000 transactions per second, which is the most important feature for the Bitcoin blockchain community.

The Lightning network’s core lies in creating a cryptocurrency pre-deposit before the transaction channel opens. Both parties are required to transfer a certain amount of coin(s) to the pre-deposit as a breach remedy transaction. However, only small payments can be transferred timely on this channel. The bigger the transaction, the higher would be the amount to deposit for breach remedy transaction. More significant transactions might imply substantial losses if one or both parties are not connected to the internet or if payments are sent to a wrong account. Additionally, Lightning network off-chain operations sacrifice part of the security associated with a decentralized system.

Sidechains

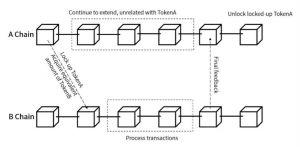

Sidechains operate as a cross-chain solution where the assets of the native blockchain (chain A in the image) are first transferred to the sidechain (chain B in the picture) for trading. Once the transaction is completed, the assets will be transferred back to the main chain. Hence, the trading speed is boosted by relieving the main chain’s workload, improving its efficiency.

However, since the main chain cannot verify all the blocks on the sidechain, which is left to the consensus of its algorithm to confirm and validate transactions, the security of users’ transactions is difficult to guarantee – this is a security gap that can lead to significant financial losses. The lack of supervision in the sidechain might go from little to non-existent, which opens a breach, compromises the blocks of the sidechain, and allows attackers to jeopardize those transactions.

Plasma

Plasma is a sidechain-based application and one of the possible solutions to the scalability challenge for blockchain but is mainly for the still unreleased Ethereum 2.0. Plasma’s security is more robust as compared to other sidechains.

The basic principle behind Plasma is to get rid of unnecessary data in the root chain. It only broadcasts completed transactions to the public chain, saving enormous amounts of processing power and memory, and making it cost-effective to interact with the system’s other participants.

Even though the Plasma mechanism proves to secure and scale blockchain technology, there are still some problems associated with this application. One of the main disadvantages of Plasma is related to the withdrawal of assets, a complex matter which doesn’t allow immediate withdrawals. Even when both parties agree to finalize a transaction, Plasma requires time – a challenging period – to achieve this goal. Moreover, another possible issue in the long run for Plasma application might be the necessity of storage space due to the volume of transaction history for validation when trading.

Conclusion

The trilemma primarily comes from the interaction of different components in the blockchain design. While Bitcoin developers have been exploring Layer 2 solutions such as Lightning, which allows some transactions to happen off-chain, Ethereum developers have been more inclined towards experimentation with sharding. Now, Asynchronous Consensus Zones is an exciting concept by JiaPing Wang from Sinovation Ventures that works to design a scalable blockchain system without compromising decentralization or security. It scales out blockchain systems by partitioning and handling workloads in multiple independent and parallel tracts called Consensus Zones. Through the zoning method, they can get higher output and capacity than the Bitcoin and Ethereum networks.

As more institutions see momentum in this act of balance, the hope to see public blockchains scaling, while being secure and decentralized, gets more robust.

___

Learn more: Bitcoin And Ethereum Scale Slower Than Cryptoverse Grows