Source: Casezy idea – Shutterstock

- A survey among institutional investors in the United States and the United Kingdom shows a growing interest in Bitcoin and other cryptocurrencies.

- A majority of respondents expect improvements in the regulation of cryptocurrencies.

Evertas Insurance has conducted a survey that provides new data on the adoption of Bitcoin as an investment. The survey, conducted in July by the market research firm Pureprofile, involved pension funds, insurers, sovereign wealth funds, family offices and other institutions in the United States and the United Kingdom.

According to the report, respondents manage assets estimated at $78.4 billion. According to the results of the survey, a significant percentage of these assets could be channelled into the crypto market. Of those surveyed, 26% indicated that they would “dramatically” increase their investments in Bitcoin, Ethereum, Litecoin, and other cryptocurrencies. In addition, the survey revealed that another 67% of participants expect their investments in cryptocurrencies to increase slightly. Overall, more than 90% of participants plan to invest in digital assets, crypto-assets and cryptocurrencies in the next 10 years.

Reasons behind increased interest in Bitcoin

According to the survey results, 84% of participants will increase their exposure to Bitcoin because they “expect the regulatory infrastructure” for the market to improve. 76% of respondents expect increased adoption and market entry of mainstream financial services funds In addition, 80% of respondents believe that the crypto market will continue to grow and can offer greater liquidity.

As for the concerns of the financial institutions surveyed, 56% were “very concerned” about the lack of insurance policies to support investments in crypto assets. This was followed by 54% who responded that they were “very concerned” about the working practices and compliance procedures of companies providing crypto services. Commenting on the results, J. Gdanski, CEO and founder of Evertas, said:

Our research shows that institutional investors are enthusiastic about increasing their exposure to cryptocurrencies and crypto assets in general, but there are clearly many issues regarding the infrastructure that supports these markets that still concerns them. These clearly need to be addressed if the full potential of investment from institutional investors in crypto assets is to be realised.

As reported by CNF, 2020 has been an important year for the adoption of Bitcoin and other cryptocurrencies by financial institutions. Among the most important facts that account for this are the growth of Grayscale’s Bitcoin fund to over $4 billion, the purchase of over 30,000 BTC by MicroStrategy, and statements from legendary investors who have entered the market such as Paul Tudor Jones.

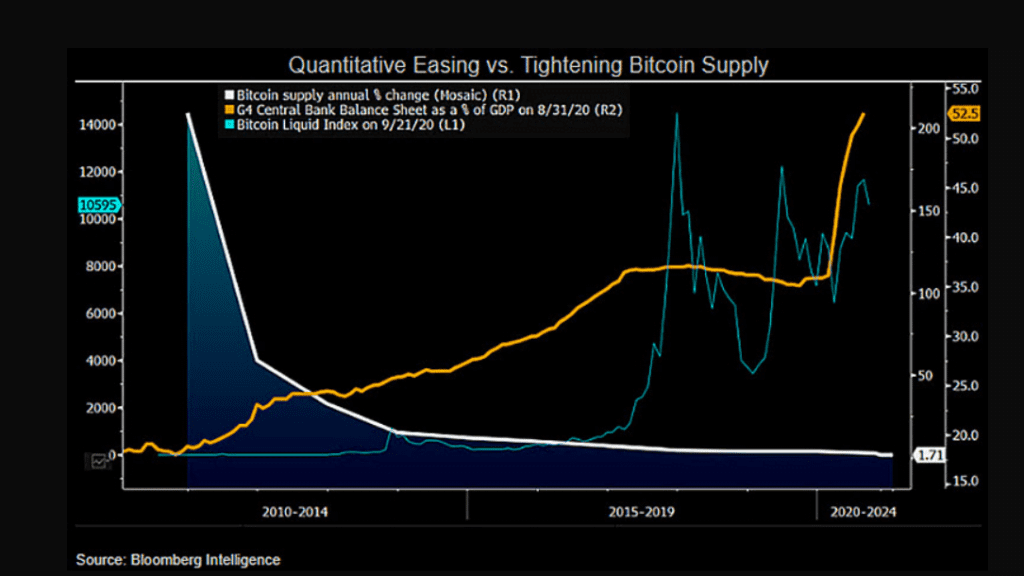

In accordance, Bloomberg analyst Mike McGlone believes that the characteristics of the cryptocurrency and current market conditions will benefit Bitcoin:

Bitcoin is a standout fixed-supply asset that should be a primary beneficiary in a period of limited potential further upside in equity and bond prices, in our view. QE juxtaposed vs. tightening Bitcoin supply leaves adoption and demand as the top price-outlook metrics..

Source: https://twitter.com/mikemcglone11/status/1308370589476966400