- The research company Messari claims that YFI is still one of the cheapest tokens in Ethereum’s decentralized finance sector, despite the price of $13,564.

- Yearn.finance is approximately returning $20 million annualized for YFI holders.

Designed to be a zero value token at launch, YFI has become one of the most appreciated assets on the crypto market. Ethereum‘s DeFi protocol token is priced at $13,564 with a 330.6% gain over the last 30 days. At the time of publication, YFI’s price was approximately 15% higher than Bitcoin’s price, which was $11,392. Despite that, the research company Messari estimates that the YFI token is still one of the most undervalued in the DeFi market.

YFI is the second most underrated DeFi token

The year.finance protocol seeks to “industrialize” the yield farming mechanism. In this way, investors can use the platform to deposit funds and achieve the highest returns without having to go through the complicated process of knowing the best platforms with the highest returns within the sector.

Therefore, yearn.finance introduced a concept known as “Vaults”. Through them, investors only need to deposit the funds, while they are allocated in the protocols with the best returns. Within this context, yearn.finance constitutes an economic model with two core components: lending optimization and yield farming optimization.

According to Messari’s analyst, Ryan Watkins, YFI charges a 5% gas subsidy fee and a 0.5% withdrawal fee for the user to withdraw their funds. In this way, the DeFi protocol has become “an industrial yield farming machine” in just two months. In that period, the protocol has achieved $390 million in total value locked inside the protocol.

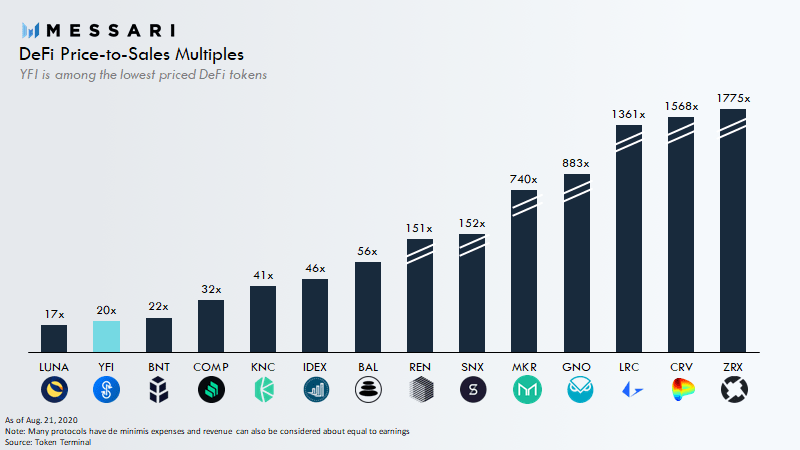

Watkins also noted that YFI currently produces cash at an annualized rate of $21 million. The analyst further stated that based on this and with year.finance’s market capitalization ($390 million), YFI has a Price-to-Sales (P/S) rate of 20x.

The indicator compares how much an asset is worth in relation to its earnings. As can be seen below, this rate is the second lowest on the DeFi sector after LUNA. A low P/S is an indicator that an asset, in this case the YFI token, is undervalued. In comparison, Curve Finance’s CRV has an S/O of 1568x, which, in contrast, indicates that the token may be overvalued.

Source: https://twitter.com/RyanWatkins_/status/1297910390031081472

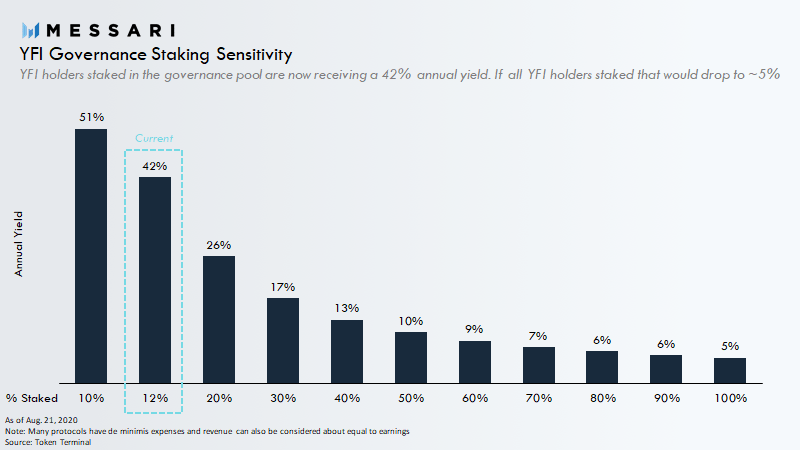

YFI’s Price-to-Expenses (PE) rate, as Watkins claims, is virtually the same as its P/S rate. This means that if all YFI holders would stake their funds, they would receive a 5% annualized profit. Currently, only 12% of YFI is in staking pools whereby YFI holders are receiving a 42% annual yield implying a 2.4x PE ratio.

Source: https://twitter.com/RyanWatkins_/status/1297910391457157132

The analysis of the Messari researcher thus indicates that the YFI price may rise even further. In addition, the returns YFI offers its holders are still high relative.

Another reason why the price of YFI could rise is the introduction of an insurance by yearn.finance. The yinsure.finance project will aim to introduce a token insurance. Depending on the success of the project, new investors could enter the DeFi sector as they see that there are more guarantees to protect their investment.