Following a divergence between the price of the Compound platform’s COMP token and the total value locked (TVL) in the DeFi (decentralized finance) platform, early token investors are now being accused by some for dumping their tokens on the market.

Popular crypto investor Andrew Kang wrote on Twitter that what is happening with COMP now can be compared with a situation where customers have been given shares of a company they buy services from, and then gradually sell off those shares.

@DegenSpartan This can’t possibly be because it listed on Coinbase and early investors are slowly dumping, right? Right? #

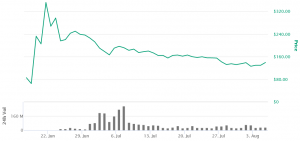

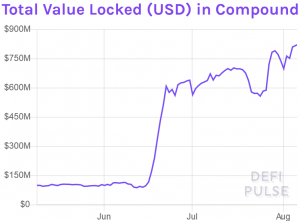

Coinbase added support for COMP on June 25, when it traded at around USD 220, dropping from USD 353, reached on June 21. Since then, COMP is down by 60%, while since the listing on Coinbase – by 36%. Meanwhile, since the listing, TVL in Compound increased by 46%, to USD 821m. By this measure, Compound is now second among DeFi platforms.

At the time of this writing (11:15 UTC), COMP had a market capitalization of USD 444m, and traded at USD 140, up 5% for the day.

COMP price chart:

___

In addition, so-called ‘yield farming’, which is widely believed to have fueled the price growth of COMP and other DeFi tokens this summer, has also been criticized by, among others, Ethereum (ETH) creator Vitalik Buterin, calling it “unsustainable in the long-term.”

The decline in the price of the COMP token is noteworthy given the buying frenzy that surrounded this token when it first entered circulation in June. Back then, the token positioned itself as the most valuable DeFi token at the time, according to DeFi Market Cap’s ranking.

Following the decline in price, however, the top spots in terms of token market capitalization in the DeFi space have again been taken by maker (MKR) and synthetix (SNX), both with market capitalizations of more than USD 500 million each.

Meanwhile, on June 17, Jake Chervinsky, General Counsel at Compound, announced that Compound Labs launched an on-chain system that “freely and continuously distributes COMP tokens to users of the Compound protocol.”

“The user distribution system is a critical element of community governance, ensuring that the protocol’s users are also its owners and managers,” Chervinsky said, adding that this was the final step in the decentralization process of the platform.