XRP, the third-ranked cryptocurrency in the world, has just experienced a massive 13% surge towards $0.30 but was not able to climb above the level. XRP’s trading volume also increased almost by 100% in the last two days.

The current XRP price is $0.294 after a slight rejection at $0.30. However, bulls still have a lot of momentum and could easily climb above this psychological level in the next few hours. On Bitfinex, the digital asset has seen an enormous increase in trading volume on the candlestick formed on August 1.

XRP Price Short-Term Forecast: Bullish

Obviously, it doesn’t take an expert to see that XRP is heavily bullish in the short-term. The daily uptrend is extremely strong but the RSI is overbought at 89 points and indicates a pullback is nearby. Unfortunately, the XRP price is still underperforming compared to ETH or BTC as it still hasn’t hit its 2020-high at $0.346.

XRP 1D – Tradingview

The next most important resistance level is found at $0.309, formed in February 2020. Bulls will then finally face the 2020-high. If XRP price starts to consolidate, buyers can use the 12-EMA at $0.245 for support.

XRP Price Long-Term Forecast: Bullish

Let’s first take a look at XRP’s weekly chart. It is obviously bullish and in an uptrend but there are still a few resistance levels to beat. The trading volume is increasing and the RSI is not yet overextended. Bulls are currently also facing the 200-EMA resistance at $0.3045, so there is a strong resistance area between $0.30 and $0.31.

XRP 1W – Tradingview

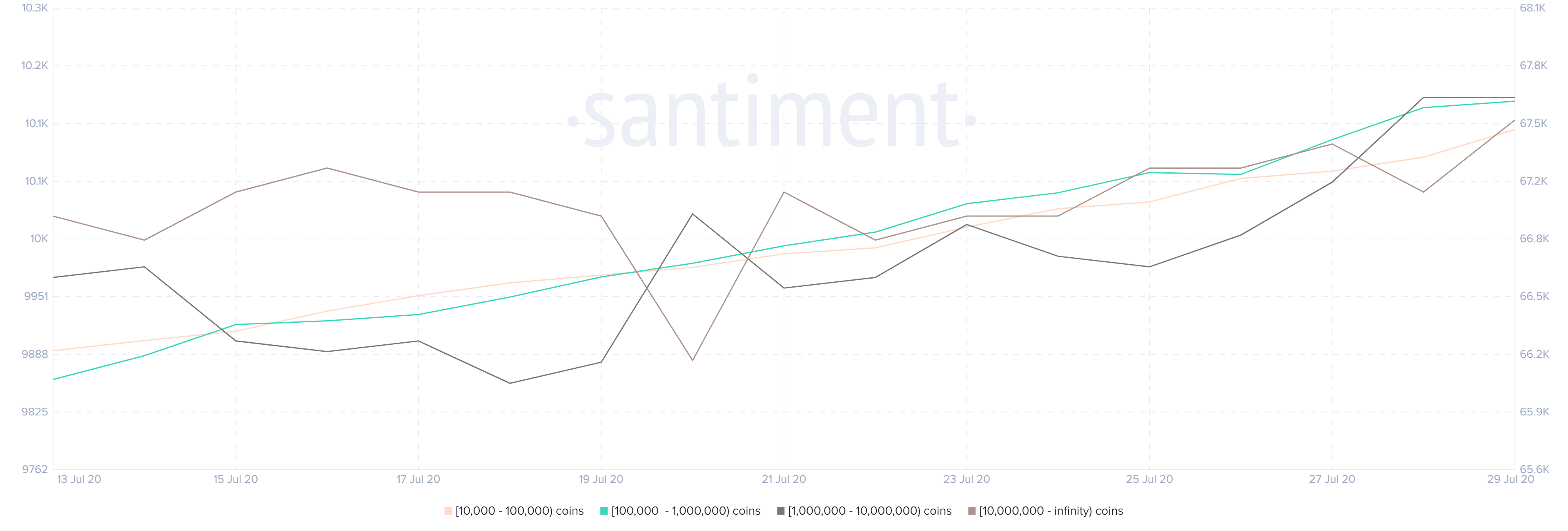

Now that’s not everything positive for XRP, according to Santiment, the number of whales has increased dramatically over the past month.

The chart above shows XRP investors with 10,000 or more coins has increased from 66,217 to 67,447, a decent increase over the past month. More importantly, holders with at least 100,000 XRP coins ($29,000) also increased from a low of 9,861 to 10,165.

Now, the heavy bags, holders with at least 1 million XRP coins ($290,000) have increased from 826 to 843, and whales with 10 million or more XRP coins also increased from 461 to 465.

Considering XRP is blasting through resistance levels and hitting new monthly-highs, the increase in holders shows great interest for XRP as one would expect whales to start taking profits not increase their holdings.

XRP Price Monthly Chart Analysis

The most important chart for the XRP price in the long-term is certainly its monthly chart. The digital asset has been in a downtrend since December 2017 but a breakout above $0.346 would confirm an uptrend.

XRP 1M – Tradingview

The next resistance level is located at $0.319, which is the 26-EMA but of course, XRP is also facing all the other short-term resistance points. The RSI is practically in the middle here and will not have any significant impact on XRP’s price.

Bulls would love to see XRP close above the 26-EMA this month and consolidate into another leg up above the resistance at $0.346 confirming a monthly uptrend. They would also want to see increasing bull volume this month which is almost guaranteed if the overall positive sentiment continues like this.

In order to support and motivate the CryptoTicker team, especially in times of Corona, to continue to deliver good content, we would like to ask you to donate a small amount. Independent journalism can only survive if we stick together as a society. Thank you

Nexo – Your Crypto Banking Account

Instant Crypto Credit Lines™ from only 5.9% APR. Earn up to 8% interest per year on your Stablecoins, USD, EUR & GBP. $100 million custodial insurance.

Ad

This post may contain promotional links that help us fund the site. When you click on the links, we receive a commission – but the prices do not change for you! 🙂

Disclaimer: The authors of this website may have invested in crypto currencies themselves. They are not financial advisors and only express their opinions. Anyone considering investing in crypto currencies should be well informed about these high-risk assets.

Trading with financial products, especially with CFDs involves a high level of risk and is therefore not suitable for security-conscious investors. CFDs are complex instruments and carry a high risk of losing money quickly through leverage. Be aware that most private Investors lose money, if they decide to trade CFDs. Any type of trading and speculation in financial products that can produce an unusually high return is also associated with increased risk to lose money. Note that past gains are no guarantee of positive results in the future.

You might also like