- Data from analysis firm Dune shows that 400,000 Ethereum addresses have used DeFi protocols.

- High transaction fees on the Ethereum network could represent an obstacle to the growth.

- Trading volume on decentralized exchange Uniswap exceeded that of Coinbase Pro yesterday.

The “DeFi fever” on Ethereum has become the most relevant topic in the crypto space. In order to take a share of the exorbitant profits offered by the protocols, investors have pushed the Total Value Locked in the DeFi sector to new all-time highs. At the time of publication, the total value locked in the DeFi sector rose to $7.76 billion. However, the real madness could be about to start.

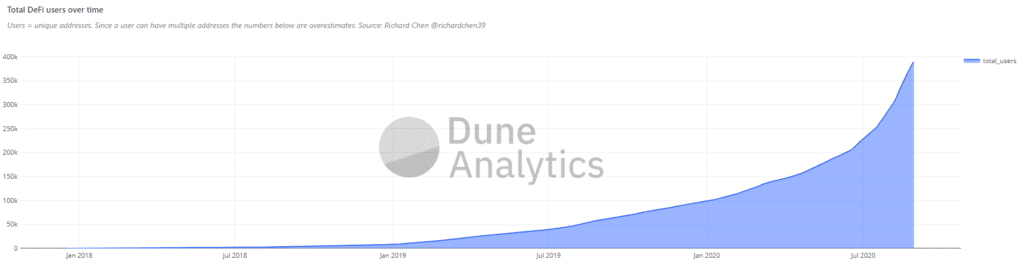

Data from analysis firm Dune, shared by analyst Byzantine General, reveals that the participation in this sector has been evolving relatively low with respect to the number of participants. As can be seen in the chart below, the number of users who have interacted with the DeFi sector is close to 400,000.

A user, according to the data analysis firm, is equivalent to a single ETH address. However, since a sole user can have many addresses, Dune offers the above number only as an estimation. The number of actual users could be much lower.

Source: https://twitter.com/ByzGeneral/status/1299764812361199616/photo/1

Considering the low number of users, even taking Dune’s initial figure of 400,000, Byzantine General stated that the “bubble isn’t even close to popping yet”. By comparison, there are 112,724,043 unique Ethereum addresses according to Etherscan data. So the growth potential for this sector is still enourmous.

Source: https://etherscan.io/chart/address

The DeFi sector could also grow if it were to receive part of the $50 billion in market capitalization, which are in “ghost chains”. The capital of less popular cryptocurrencies that will one day perish will flow into the DeFi sector, as “Into The Ether” stated:

The ghost chain reckoning is coming. There is well over $50bn in market cap value for chains no one uses. They will all be usurped by DeFi apps with actual use by the end of this market cycle.

However, it is necessary to consider that the Ethereum is already facing a strong limitation. The congestion caused by the rapid growth of the DeFi sector has led to an unprecedented increase in transaction fees. Data from EthGasStation shows that the standard fee for a transaction to be validated on the Ethereum network is currently 199 Gwei. To put this in perspective, in previous years a rate of 10 Gwei was considered high in periods of high congestion.

Is the Ethereum DeFi sector sustainable?

The unprecedented growth of the Ethereum DeFi sector has also made many consider its sustainability. The co-creator of Ethereum, Vitalik Buterin, has been one of the most critical voices towards the DeFi sector and has stated that the profits users currently make from yield farming are unsustainable. Chainlink co-founder Sergey Nazarov agrees.

Speaking at 2020’s Smart Contract Summit, Nazarov said that the massive profits that users make will end. However, Nazarov said the protocols will remain online when the “greed phase” is over. The creator of yearn.finance, Andre Cronje, highlighted the exciting side of the growth that the DeFi sector has seen. Although he admitted that it is also in a phase of experimentation:

So often you see people build stuff you could never have envisioned—like someone launches a product that uses your platform and you’re like, how the hell could they think of this? Then you play with it and you think it’s cool. There’s much less of a plan and a lot of exploratory fun.

Meanwhile, the decentralized exchange Uniswap has surpassed Coinbase Pro in trading volume for the first time in history. At the time of publication, Uniswap recorded $472 million with a 10.96% increase in trading volume for the last 24 hours. Coinbase Pro on the other hand only reached $416 million. If the DeFi sector of Ethereum continues to grow, this could become the new norm.