- The Ethereum based YFI, the governance token of yearn.finance protocol, has broken its all-time high price and stands at about $10.800.

- An analyst is predicting the continuation of YFI’s upward trend and a price of 21,000 USD.

After a price recovery, the governance token of the yearn.finance protocol, YFI, is gaining attention once again. At the time of publication, YFI was trading at $10,799 with a price gain of 50.5% in the last 24 hours. Although it recorded remarkable gains during this period, those of the monthly chart are even more impressive at 1265%.

Originally, YFI was released with a value of $0. Therefore, its rise to the current price is even more impressive. Within the first 24 hours of trading, the token recorded a profit of 2,000%. In the first week, the price even rose by 11,000%. The objective of its launch was to change the governance model of the year.finance protocol to give more participation to the community.

Reasons behind the rally of the Ethereum based YFI

The main reason behind the YFI rally, as data scientist Alex Svanevik explained, is its low supply. With just 30,000 tokens, there simply aren’t enough tokens to meet market demand. Additionally, as Svanevik points out, 60% of YFI’s supply is already allocated in staking pools:

If you’re wondering why YFI keeps pumping, consider this: >60% of total supply is locked in staking pools.

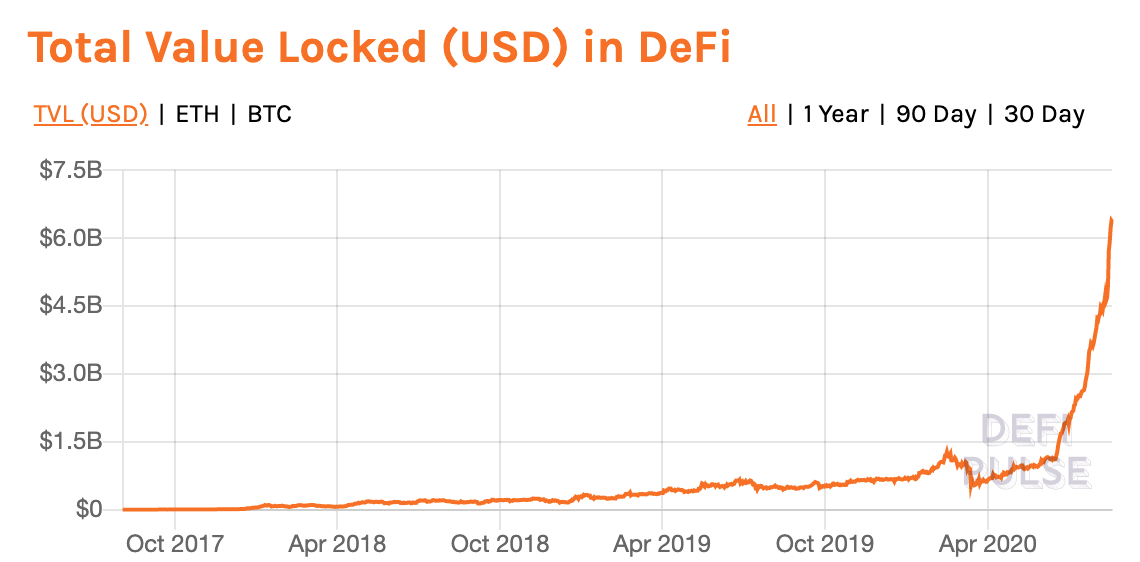

According to DeFi Pulse data, the total value locked (TVL) in the yearn-finance protocol now amounts for $604 million. This figure represents an all-time high for the platform. At the same time, the TVL is at an all-time high of $6.37 billion. Ethereum’s DeFi has been growing steadily since late June this year. So the rise of the YFI token can also be attributed to the growing popularity of the Ethereum DeFi in general. In its all-time graph, the surprising growth of the DeFi sector can be seen.

Source: https://defipulse.com/

Despite this, developer Dennison Bertram points out that the low supply of the YFI token makes it an unviable investment for most users. Bertram noted the following:

I mean there are only 30,000 of them. So I don’t think it turned too many people into millionaires if any to be honest. There was almost never enough supply available, and the folks who were able to “yearn” enough of them, did so via providing millions in liquidity…

Despite that, the outlook for the token of the yearn.finance protocol, according to the analyst, remain bullish. Bertram claims that YFI is the most undervalued protocol in the DeFi market. In that sense, he expects YFI to be at 21,142 USD in the future.

YFI is the most undervalued protocol in the history of crypto. If valued like $COMP today: 1 $YFI = $21,142.37. What protocol will grow TVL with vaults, leveraged stablecoins, and yinsurance? Has no VCs to dump on you… and is 100% #DeFi?