Source: NothingIsEverything – Shutterstock

- Stani Kulechov, co-founder of the Ethereum based Aave, has revealed the intention to tokenize Teslas as collateral.

- The head of DTC Capital, Spencer Noon, argues that Aave is the most attractive DeFi token for investors in the long run.

Stani Kulechov, co-founder of one of the fastest growing protocols of Ethereum‘s DeFi sector, Aave, has come up with an idea that has attracted the attention of the crypto community. Via his Twitter account, Kulechov expressed his wish to include Tesla’s cars as collateral in the Aave protocol. In his tweet, which was directly addressed to Tesla CEO Elon Musk, Kulechov wrote about a possible use case linking decentralized financing (DeFi) to space travel. Kulechov wrote:

Elon Musk I would be excited some day to tokenize Teslas, allow people to use the cars as a collateral in Aave to borrow $USDC and spend it for affordable mars trips. This is called DeFi and it’s coming to improve finance.

Although some community members and users of Tesla cars have responded positively to Kulechov’s idea, Tesla’s CEO has not responded to the mention. Musk is characterized by a particular style of responding to his messages and interacting with his followers on Twitter. In addition, Tesla’s CEO has confirmed that he is a Bitcoin holder, however, he has never spoken about DeFi on Ethereum, TRON or any other platform.

Has Aave the strongest fundamentals in Ethereum’s DeFi?

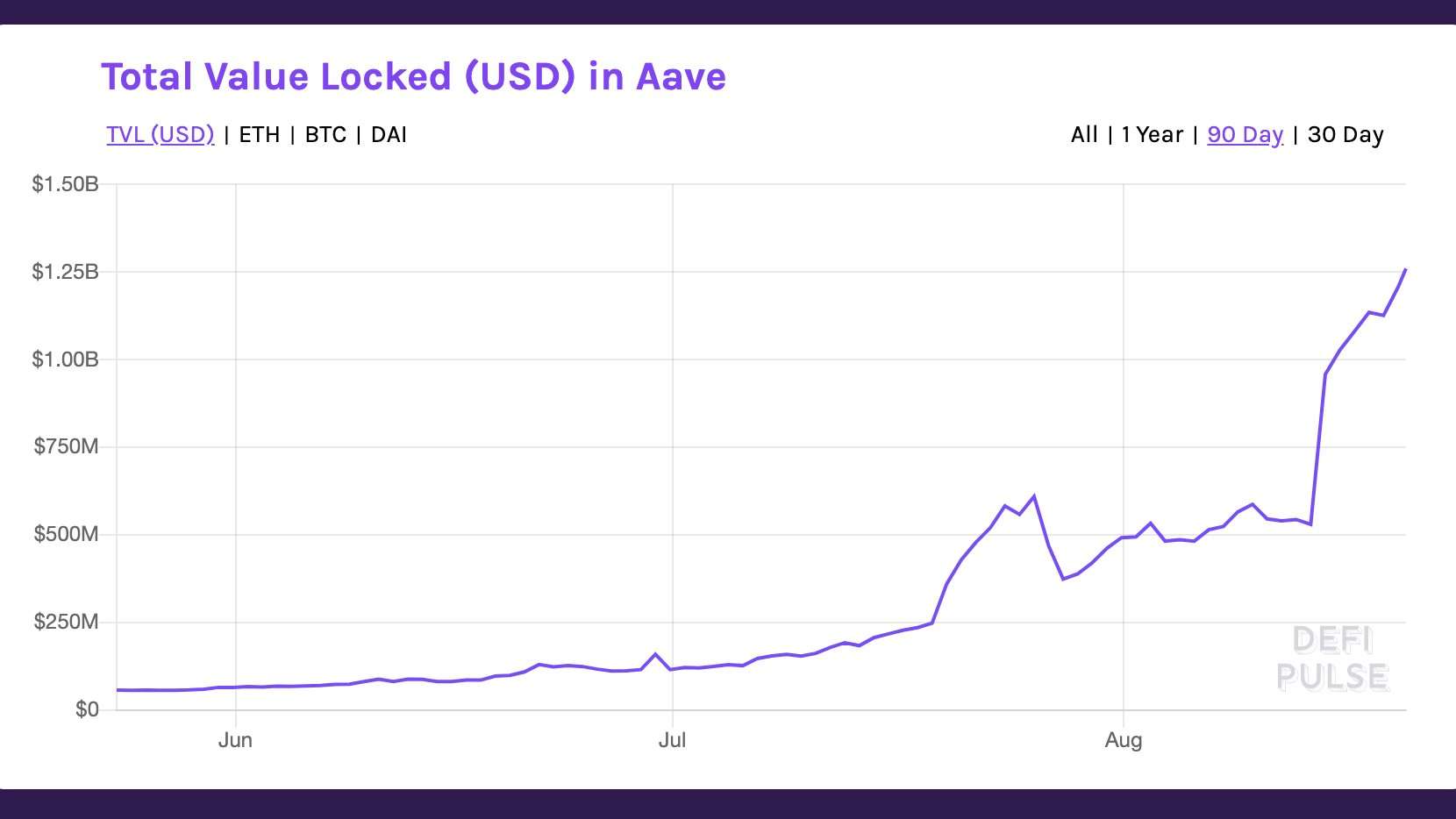

As mentioned, Aave is one of the rapidly growing protocols in the DeFi sector. According to its official website, the current size of the Aave market is about $1.5 billion. Therefore, it constitutes a significant portion of the $6.64 billion locked in the Ethereum DeFi.

According to the head of DTC Capital, Spencer Noon, Aave has very bullish fundamentals. In addition, Noon has noted that the lending protocol is distinguished from others because it has grown without “extra incentives” such as liquidity mining. Noon commented as follows, showing the graph of Aave’s impressive growth over the past 90 days:

One of the best signals of PMF in #DeFi is if a project can succeed w/o extra incentives (liquidity mining). Aave doesn’t have LM yet it’s still one of the biggest beneficiaries of new yield farming activity. At $1.26B TVL and only $759M mcap—the fundamentals are so strong.

Source: https://twitter.com/spencernoon/status/1296445917919412224

MultiCoin Capital’s managing partner, Kyle Samani, responded in a similarly bullish tone to Noon’s tweet. Samani said that if he had to choose an Ethereum DeFi asset to hold for two years, he would choose Aave. Samani added that Aave has the best combination on the Ethereum DeFi ecosystem: token distribution, community, good innovation rate and reasonable valuation with room to grow. He also added that his investment firm has a long position with respect to Aave.

In line with this, Aave’s LEND token has shown a bullish performance recently. At the time of publication, LEND is trading for $0.56 with a gain of 4.55% in the last 24 hours. In the weekly and monthly chart, LEND is showing a gain of 19.24% and 96.06% respectively. As reported by CNF, the loan protocol will migrate its LEND token to the AAVE token as part of the change in its governance model. This will seek to give more power and incentives to users over decisions made in relation to Aave.