A crucial week for the S&P 500/SPX (SP500) and stocks in general

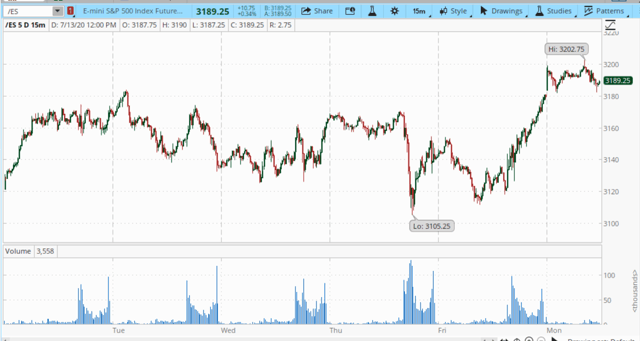

Earnings season is kicking off with big financial names, and SPX is at a critical technical inflection point. Naturally, there are a slew of other fundamental factors to consider like a surge in coronavirus cases as well, but let us look at this technical image first.

Source: Think or Swim, Ameritrade

We can see that SPX futures are trying to break above 3,200. If this occurs, the 3,220 level will get tested next. Now, if the SPX can clear 3,220 I believe new ATHs could materialize relatively quickly (3-4 months). However, several key fundamental factors likely need to occur for this scenario to realize.

To the downside, the 3,180 support level is quite important. I expect it can get tested, and even if a breach occurs I don’t expect the SPX will go far below it. Perhaps to roughly 3,150 in a base- to worst-case scenario. However, in a worst-case scenario, I will be concerned if the 3,100 level starts to break down.

The Bitcoin Market

Bitcoin continues to move roughly in tandem with the S&P 500. However, what should be considered is that while Bitcoin (BTC-USD) may move in a very narrow range, some key alt coins are up by 40-50% or even over 100% just in this quarter alone.

(VET-USD): Surge by roughly 120% in a few weeks before correcting.

Source: Binance.com

Source: Binance.com

Many of the top “altcoins” resemble well positioned companies in a market where demand for blockchain-related services is likely to rise substantially in future years. I view many of the digital asset enterprises as viable businesses with enormous growth potential.

The primary difference between digital asset enterprises and traditional businesses difference is that you buy stock to own a part of company and you buy “coins” to own part of a digital network/project (business).

Bitcoin

Bitcoin is battling with the $9,300 level and will likely go up toward the higher end of its current trading range of around $9,000-$9,500. Whether we can break out to the $10k level remains to be seen, but I suspect that if SPX proceeds higher so will Bitcoin, and the “vibrant” digital asset market.

Bitcoin is battling with the $9,300 level and will likely go up toward the higher end of its current trading range of around $9,000-$9,500. Whether we can break out to the $10k level remains to be seen, but I suspect that if SPX proceeds higher so will Bitcoin, and the “vibrant” digital asset market.

To the downside, we do not want to see a break below $9,200, or worse, $9K. If $9K breaks down decisively, BTC will likely test a lower level of $8K-$7,500. For now, I find this scenario remote given the fundamental backdrop for the cryptocurrency complex.

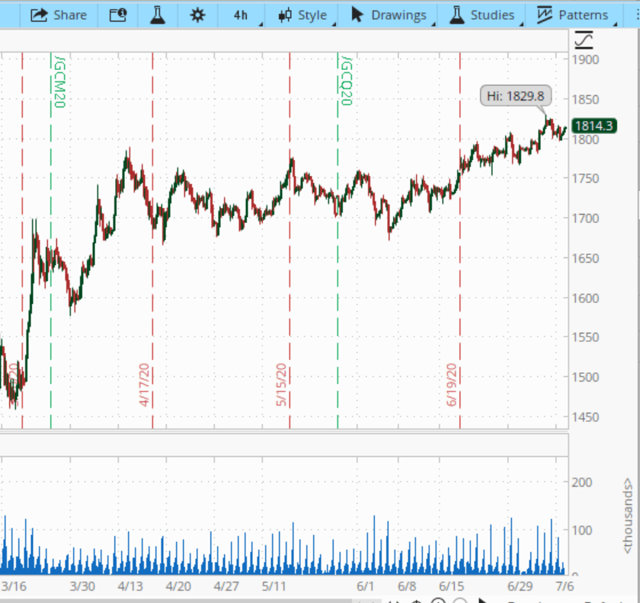

Gold Headed Higher

Gold futures show a very nice continuation of gold’s bull market run after the mid-march flash crash.

Gold futures show a very nice continuation of gold’s bull market run after the mid-march flash crash.

Gold companies/ETFs we like: (KGC), (KL), (NEM), (AGI), (GDX), (GDXJ), (PAAS), (FSM), (AG), (SLVP), (SIL), and others.

Gold companies/ETFs we like: (KGC), (KL), (NEM), (AGI), (GDX), (GDXJ), (PAAS), (FSM), (AG), (SLVP), (SIL), and others.

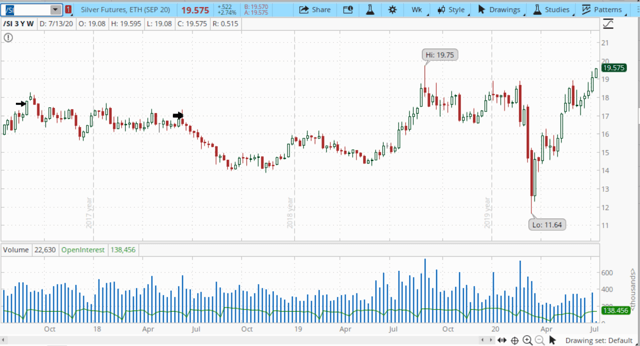

Silver

We see that silver is likely to break out to $20 plus new multi-year highs soon. So, the best way we see to play the silver market is through the quality silver mining companies.

We see that silver is likely to break out to $20 plus new multi-year highs soon. So, the best way we see to play the silver market is through the quality silver mining companies.

Banking Rebound

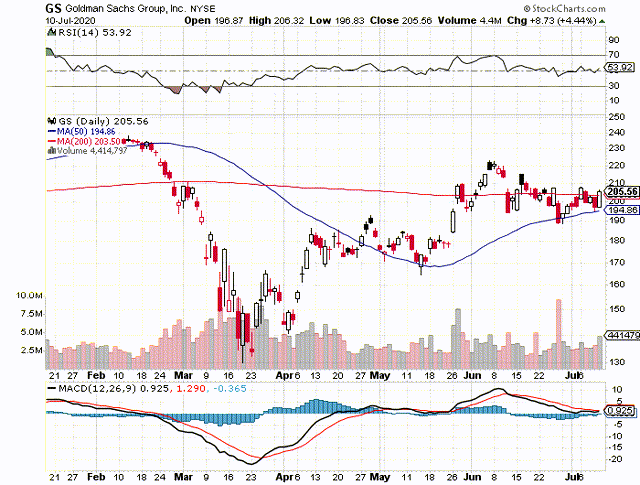

Bank earnings are going to start coming in this week, and I expect that many, especially the investment banking businesses had stronger than expected quarters. Therefore, certain banks are likely to outperform here.

Names we like:

Goldman Sachs (NYSE:GS)

Goldman should do well due to trading and other business segments. Also, names like:

JPMorgan (JPM)

Furthermore, in the banking sector: We also like the (KRE) ETF, Citi (NYSE:C), and Srerbank (OTCPK:SBRCY), and others we think may do well going forward.

Furthermore, in the banking sector: We also like the (KRE) ETF, Citi (NYSE:C), and Srerbank (OTCPK:SBRCY), and others we think may do well going forward.

The Bottom Line

Stocks look like they may continue their rally here, as we see rotation to sectors like financials and others. Also, SPX futures are likely about to breakout above 3,200-3,220. Once this occurs, the market has a good chance to go new ATHs.

However, GSMs (gold/silver/miners) have been the place to be, as many names in our portfolio gained 50%-70%, or even more than 100% in Q2. Bitcoin and digital assets also gained quite a bit in Q2 for us, 47%. Stocks may continue to move higher, but there are plenty of more stable and more profitable places to invest in like GSMs in my view.

Digital assets are an option for more risk tolerant market participants, but should not typically exceed 5%-10% of a portfolio, unless you are very committed.

The bottom line is that we may be entering the “everything rally” phase. The question is, should this trouble us?

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

Disclosure: I am/we are long ASSETS MENTIONED. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.