Photo by Jack Taylor

As highlighted a few days ago in this article: Altcoins will rocket when bitcoin is strong. A host of altcoins have exploded since I wrote this January 8. As someone that eats my own dog food, you can imagine I’m quite happy.

Altcoins have rocketed recently.

This event has left lots of people flummoxed, but the answer to why this can happen is “beta.” Beta is a measure of volatility. The more beta there is, the more volatile the price of an instrument will be.

Back in the day beta used to be an investment thesis. To get an outperformance on your portfolio you bought “high beta” stocks because they had more ping in them in the market than low beta stocks. So if you thought things were going up, you would buy high beta to get higher returns than you would from a basket of low beta stocks.

You can use high beta to hedge too, and I use the high beta of bitcoin to hedge my stocks because the sort of shock that would knock the Dow on its rear is just the sort of news that would sling bitcoin to a lunar orbit.

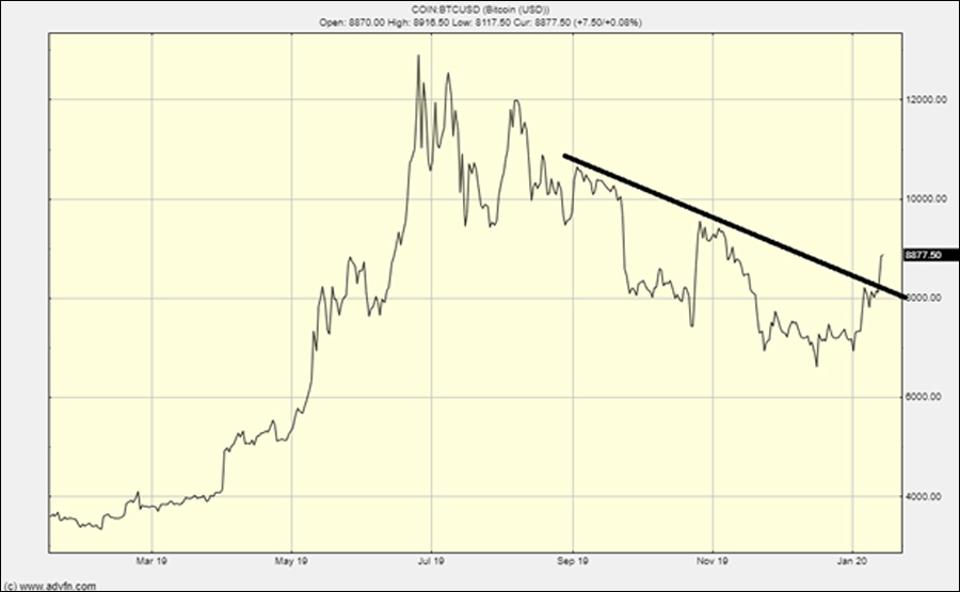

Without doubt, something is up and its reflecting in bitcoin’s strength; you don’t have to be much of a chartist to see that it has broken out. I could have written about this earlier but this kind of breakout is fragile and easy to second guess. Such a chart is simply a very bullish indicator and four times in five such a chart pattern will fail.

Bitcoin has broken out

However, the chart looks great and bitcoin is showing good strength and there is certainly enough geopolitical fuel out there to slingshot the market should things go wrong. I have said before, you will read about what moves bitcoin a few days after it happened and you can imagine not all bad things “people in the know” hedge against, happen, so sometimes you will never know.

Meanwhile, you can see this big altcoin rally right down the charts of coins because as the top coin rockets so the small ones follow as the speculators pile into the minnows. Bitcoin drives everything and the moves of the altcoins are reflections of their volatility and their exchange exposure to trading and acquisition.

Markets always want to personify moves and so in this case the move in Bitcoin SV (BSV) has come into focus, the idea presumably being that the unlocking of a huge chunk of bitcoin would lead to them being sold and the proceeds invested in bitcoin SV, thus pushing the price of bitcoin SV towards the hugely higher levels of bitcoin. Another idea for the move is that bitcoin SV is about to get a technical upgrade. I’m always skeptical about stories driving markets. Money flows drive markets and few have the kind of money needed to make much of an impact and few that do get to keep it.

If bitcoin continues its ascent then the high beta altcoins will outperform on the way up as they will underperform on the way down. These financial instruments are tiny in comparison to other instruments and can move hugely. This knife cuts both ways.

My instinct in crypto trading is to flip out of whatever goes vertical into BTC, only to consider returning after the dust has settled. I did this today with Bitcoin Cash (BCH). I’m leaving my other altcoins because one thing equities teach you is its tricky to time the market, so if you are going to try, best stage it.

While flipping out of alts into bitcoin after this huge spike may prove clever or stupid, the main message is, bitcoin is strong and altcoins are responding to this strength. Bitcoin’s chart looks great and the chances are that money flow is driving this and that is coming from one of the trouble spots on the globe we could all do with less of. If this continues then the speculators will climb on board and off we will go on another big rally.

However, we should remember that the target of bitcoin believers is a number of years off so the key thing is not to trade the market and get left on the beach when, as is almost inevitable, you mistime a trade and get left holding “fiat” as crypto roars away.

—-

Clem Chambers is the CEO of private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.