When bitcoin (BTC) surged to almost $20,000 per coin in 2017, everyone who had been living under a rock on the subject of cryptocurrency suddenly woke up and started paying attention.

Bitcoin and its cousins, collectively known as “cryptocurrency,” were suddenly all the rage. People made and lost fortunes, while governments and investment advisors sounded alarm bells and tech influencers sang arias of praise.

There is still a lot of cultural noise around cryptocurrency. Let’s cut through the noise and get back to basics by reviewing the history and defining features of three of the most popular cryptocurrencies.

Two points of clarification, first:

- A cryptocurrency is a form of digital currency built on a decentralized ledger technology, sometimes called a “blockchain.”

- The platform of a cryptocurrency is usually capitalized, while the currency itself, sometimes called a “token,” is not. Hence, a “bitcoin” is a token traded on the Bitcoin network, while “ether” is a token traded on the Ethereum network.

Let’s dive into the three top cryptocurrencies and their place in the crypto universe.

People often use “Bitcoin” and “cryptocurrency” interchangeably. The words aren’t synonyms. Bitcoin is a cryptocurrency, but not all cryptocurrency is Bitcoin. Many cryptocurrencies followed in its wake, but Bitcoin (BTC) enjoys a privileged status in the space because it was the first.

Not only did it lead the way on the very idea of cryptocurrency, but it debuted in tandem with the revolutionary technology that made all other cryptocurrencies possible—blockchain, the first “distributed ledger.”

The origins of Bitcoin are shrouded in crypto-hacker mystery. In 2009, the white paper Bitcoin: A Peer-to-Peer Electronic Cash System, appeared online, backlinked to an email sent to a cryptography mailing list. It describes the cryptocurrency as well as blockchain itself.

The manifesto was not anonymous—it was attributed to the name “Satoshi Nakamoto.” However, Nakamoto is widely believed to be a pseudonym, and despite a few quasi-hilarious diversions, no credible evidence points to an identity for the person (or persons) who actually invented the technology or wrote the code. There was no patent—it was open-source code, and anyone could copy it.

Cypherpunk Hal Finney bought the first ten Bitcoins sold. “Nakamoto” is estimated to have mined about one million Bitcoins before disappearing into the ether in 2010. Since then, all Bitcoins have been mined by later adopters.

Bitcoin first made headlines as the preferred currency of The Silk Road and other darknet marketplaces, hotspots for online dealing of drugs. Cryptocurrency was revealed for its power to act as an untraceable, unhackable currency outside the bounds of government control.

Governments did not take kindly. Silk Road founder Ross Ulbricht received a draconian double life sentence when he was uncovered. Six countries, including China and Russia, have made Bitcoin transactions illegal.

In the late 2010s, Bitcoin became popular as a kind of “investment vehicle,” peaking at $19,783 per Bitcoin in January of 2017 before returning to earth a little. Investment experts have expressed grave misgivings about Bitcoin as an investment vehicle.

Bitcoin remains the most popular cryptocurrency in the world. It also represents a key component of the increasingly popular cryptocurrency day trading market, according to this guide from Cove Markets.

What Makes Bitcoin Different?

Bitcoin is distinguished by its goals. It seeks to replace Fiat currencies with a new kind of currency that replaces the “full faith and credit” of a government or king as the underpinning of its value.

Consider gold. It is valuable because it is scarce, beautiful, and unchangeable—press it, squish it, grind it to dust, it will always be gold.

Bitcoin is scarce—new tokens can only be “mined” by complex algorithms that take expensive computers to execute. The architecture only allows for a certain number of Bitcoins to be mined. Once the last bitcoin is mined, that’s it. No more bitcoins, ever. The supply will be frozen, regardless of the demand.

Bitcoins are also immutable, like gold. Whereas some cryptocurrencies have executable code, Bitcoins are inert, its markings used solely for record-keeping.

Bitcoin was an original, created to do one thing—speed up, decentralize, and ensure the integrity of monetary transactions without government involvement.

Bitcoin may be the largest and most popular cryptocurrency network, but Ethereum, with its token coin ether, is gaining ground.

It wasn’t designed to be a Bitcoin competitor but it became one anyway. In fact, it was created by the co-founder of Bitcoin Magazine, Vitalik Buterin. In 2013 Buterin proposed that Bitcoin would be stronger if it included a script from which decentralized applications could be built. His idea met with limited interest. So he decided to build it himself.

Ethereum was unveiled in January of 2014. It went live in 2015 with 72 million ether coins available for purchase.

In 2016, hackers exploited a flaw in the smart contract architecture to steal $50 million worth of ether. In response, the ether ledger was split into two different blockchains. Ethereum (ETH) refunded the stolen tokens, while Ethereum Classic (ETC) continued to exist to honor pre-existing tokens.

Ethereum 2.0 is currently in the works.

What Makes Ethereum Different?

Buterin and a long list of contributors founded Ethereum to help distributed ledgers reach their potential as a technology. The cryptocurrency is an outgrowth, not the main point. In fact, Buterin intended Ethereum to be a complement to Bitcoin, not a competitor. But ether became a competitor to bitcoin anyway.

Ethereum is powered by the cloud-based Ethereum Virtual Machine (EVM). Unlike the Bitcoin script, EVM is a Turing-complete machine, able to recognize and/or decide other data-manipulation rule sets.

Again, Ethereum was not created to disrupt the currency market—it was created to help blockchain reach its full potential. As such, it pairs distributed-ledger technology with executable script, enabling the creation of:

- Decentralized applications, cloud-based and not dependent on traditional servers.

- Smart contracts, decentralized and impossible to falsify.

- Other cryptocurrencies. Ether is actually not the only cryptocurrency hosted by the EVM. Ethereum hosts 47 cryptocurrencies and counting.

Litecoin (LTC) was released and went live in October 2011, the brainchild of Coinbase Engineering Director and former Google employee Charlie Lee. It branched off from the Bitcoin Core client, but it featured a larger maximum number of coins and a faster block generation time—2.5 minutes per block instead of 10 minutes per block on Bitcoin.

In May of 2017, Litecoin was the currency used for the first Lightning Network transfer. This layer-2 blockchain payment protocol was used to transfer 0.00000001 LTC from Zurich to San Francisco, with a transfer time under one second.

What Makes Litecoin Different?

The faster block transfer rate means that litecoin transactions process much faster than bitcoin—and fast transactions were a key component of Bitcoin’s raison d’etre. However, the use of the hard-memory function scrypt algorithm in Litecoin makes them much harder and more memory-intensive to mine. So in one sense, litecoin really is lighter than bitcoin … but in another sense, it is heavier.

In May 2017, Litecoin became the first Top 5 cryptocurrency to adopt Segregated Witness (SegWit), a soft fork change in transaction method meant to bypass block size limits, reduce transaction malleability, and allow optimal data transfer by detaching the unlocking signature (the “witness”) and reattaching it at the end of the transaction.

As decentralized blockchain functions gain in popularity and competitors flourish, expect cryptocurrency to become even more hot and even more hotly debated. Mostly insulated from geopolitical influences and enshrined in a decentralized data cloud, cryptocurrencies are here to stay.

Related

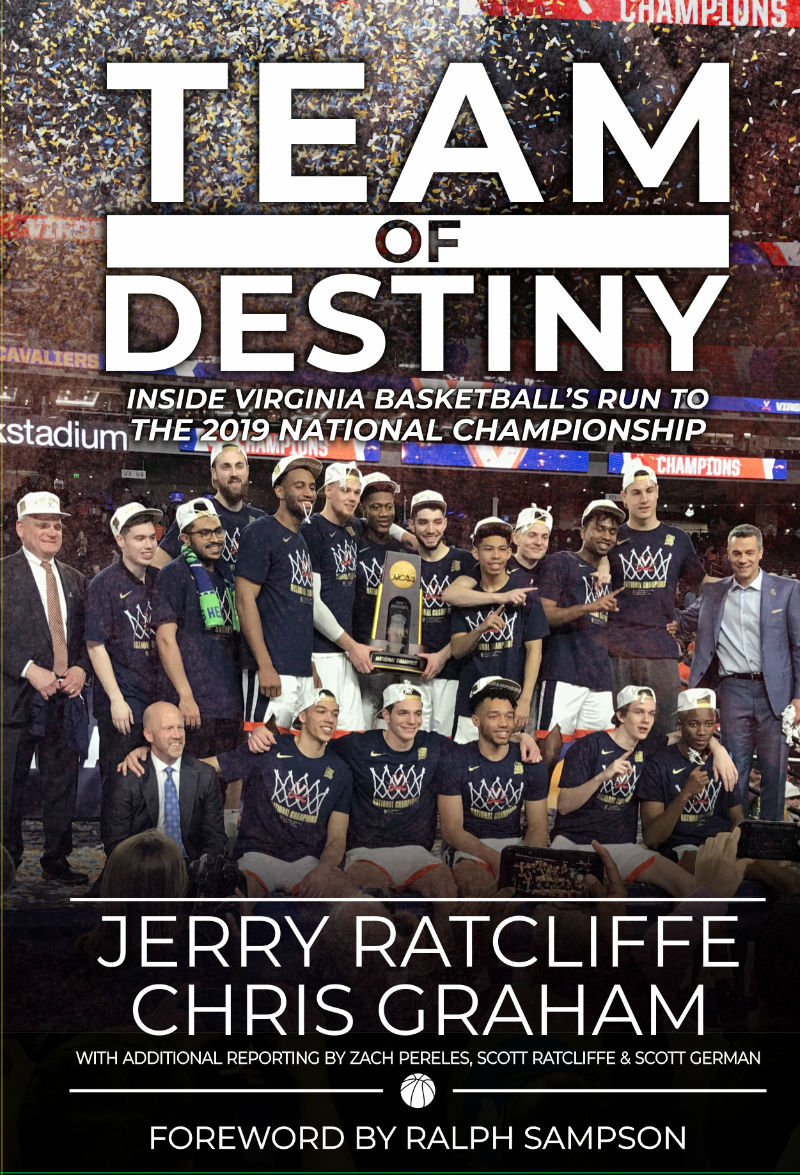

Team of Destiny: Inside Virginia Basketball’s Run to the 2019 National Championship, by Jerry Ratcliffe and Chris Graham, is available for $25. The book, with additional reporting by Zach Pereles, Scott Ratcliffe, and Scott German, will take you from the aftermath of the stunning first-round loss to UMBC in 2018 through to the thrilling overtime win over Texas Tech to win the 2019 national title, the first in school history.

Dick Vitale on Team of Destiny: “This is a hoops story you will LOVE! Jerry and Chris capture the sensational and dramatic championship journey by Tony Bennett and his tenacious Cavalier team. UVA was Awesome Baby and so is this book!”

Ralph Sampson on Team of Destiny: “Jerry and Chris have lived and seen it all, even before my time. I highly recommend this book to every basketball fan across the globe. This story translates to all who know defeat and how to overcome it!”

Feedback from buyers: “Got the Book in the Mail Saturday, and could not put it down! Great read and great photography as well! Love all of the books I’ve received, but hands down, this is my favorite!” – Russell