getty

Every computer operating system needs a killer app. Without an application that grabs the imagination of the early adopters, a piece of technology will languish. The PC had WordStar, the Apple

Once a platform has the killer app, illicit or otherwise, it is on its way to the mainstream where general usage of its utility will put the technology into the hands of millions.

A platform can have multiple killer apps in the same way as a game console can have multiple must-have games to drive adoption.

For Ethereum, the initial killer app was the crypto IPO, the so called ICO (initial coin offering), creating an unregulated method to raise money for ideas, real or phony, in a form that generated uncontrolled greed and excitement in a naive audience. This kind of financial promotion has been a blueprint for success since time immemorial, success at least for the hucksters who swarm into such a stew pot. That gold rush scammer feeding frenzy was stamped out by the regulators but it made clear the potential of decentralized computing coupled with the blockchain and cryptographic mechanisms, to enable a whole new galaxy of applications with cryptocurrency the route to the loot.

So here it is, the next Ethereum killer app: DeFi.

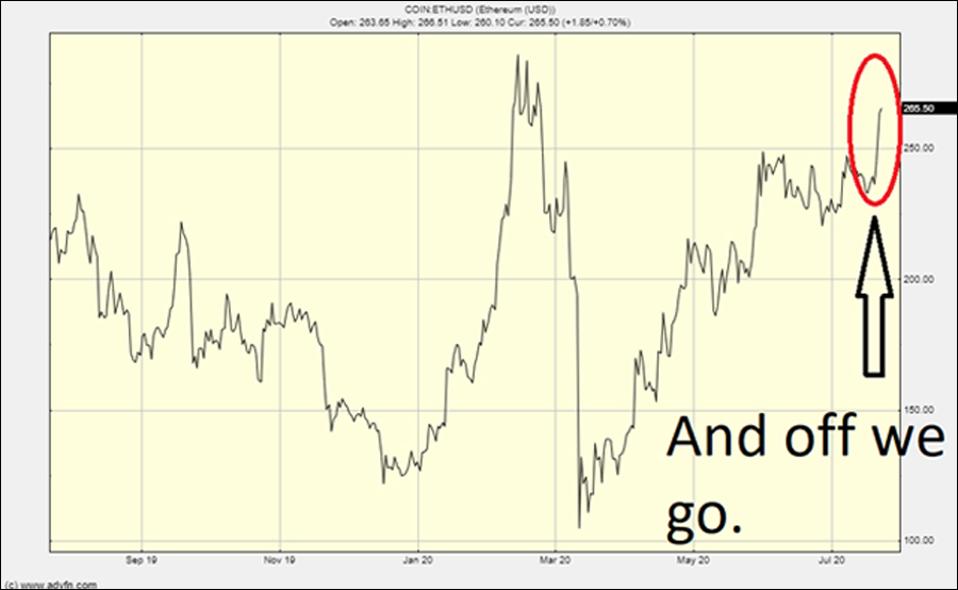

The Ethereum chart shows the price is taking off

DeFi stands for decentralized finance. What is that? It’s a range of semi-familiar financial products reskinned for the crypto age.

Imagine you could anonymously deposit some collateral with a bank and then borrow cash on the security of that collateral, then withdraw the borrowed money so you could spend it, without them knowing who you are. Of course you can’t do that at Wells Fargo

Take sites like Aave and Compound. You could put $1,000,000 of ethereum into their process, completely anonymously, pull out as much stablecoin, like tether or USDC, as that collateral will let you, send it to yourself, sell it, send the dollars to your bank and buy a house. Up to the point it hits your bank the whole process is as near to instantaneous and anonymous as you can get.

Instead you might simply put ethereum or other crypto tokens into these systems and earn interest. Aave and Compound have nearly £2 billion of crypto on deposit, so this is already a material development.

In typical crypto-style, this is just the entrance to the rabbit hole with both services having their own token attached to their existence. With Compound, you get doled out compound tokens depending on how much you have deposited to add to the interest you will get from your deposit. The compound token is currently worth about $160 and earnings on it mount up over the months to add to deposit rates for coins you put on the system. Those interest rates are from fractions of a percent per year to an astonishing 56% on the dai stablecoin as I write. Of course it has to be complex as it’s crypto, and these rates flap all over the place depending on demand and supply and heaven knows what else is going on in these byzantine complicated gamified systems. I can practically smell the counterparty risk.

To get a feel for this ecosystem I have put $500 into Aave and Compound to see how it rolls and there is something magical about watching your interest roll up in real time. In a week or so I am up $1 of interest on my $500 USDC stable coin on Aave and on Compound the same deposit has brought in 42c in interest and 65.5c in Compound coins, each roughly a 4.8% return over a year. However, the outcome is utterly impossible to judge because rates and the drivers of interest rates are utterly unpredictable due to supply and demand for borrowing and lending.

Even so, thus far the returns sound pretty good in these zero interest times. Take some dollars, swap into a stablecoin like Coinbase’s USDC, bang it into a DeFi platform and get a nice 4%-plus interest rate… yes please Mr. Nakamoto… but…there is risk and cost.

Because DeFi has exploded, the transaction costs in Ethereum for various bits of the DeFi chain mount up fast and significantly. Ethereum charges transaction fees to put your coins into a system and to take them out again. Just to take your deposit out is $13 as I write, and to deposit it is $5, so one round trip cost is the interest on $360 of stablecoin deposited for a year. This is a fixed charge for $1 or a $1,000,000 of crypto deposited. It is what Ethereum’s system charges for the processing of the deposit or withdrawal. As such, to get your costs down to a reasonable level of say 0.1% of the yearly cost of a deposit and withdrawal cycle, you have to be depositing a lot of money, say $50,000 to be sensible.

To me, putting $50,000 with any crypto outfit is a bigger jump in faith than I’m prepared to make, but the scope of the potential for amazing financial products is just colossal and clear to see. At some point when a trusted brand offers such a service or the systems out there are seasoned enough to put cares aside, this is something I’m going to put a lot of capital into to sweat some yield.

On the lending edge of this leading edge, the superusers are getting up to all sorts of amazing high risk stunts, of borrowing and relending to play these new systems like fruit machines. Good luck to them and they will probably need it.

As they do so, transaction costs on the Ethereum network are spiralling up.

To play these high-risk games or to even poke these new wonders with an exploratory stick of money is enough to give Ethereum a kick up the pants in value and since I wrote my Ethereum will go to the moon article, it appears that that process has begun.

The current DeFi movement is just the beginning of this wave of killer financial apps. Slavered in risk, powered by greed and gamified like a primitive mobile game, this new crypto frontier will erupt. As Ethereum powers this ecosystem it will appreciate dramatically as users scramble for the Ethereum “‘gas” to play at the table.

There are a number of positive drivers for crypto right now, no less so than tensions between the U.S. and China and massive worldwide money printing. DeFi is another driver and it will mean ethereum will outperform the pack.

—-

Clem Chambers is the CEO of private investors website ADVFN.com and author of 101 Ways to Pick Stock Market Winners and Trading Cryptocurrencies: A Beginner’s Guide.

Chambers won Journalist of the Year in the Business Market Commentary category in the State Street U.K. Institutional Press Awards in 2018.