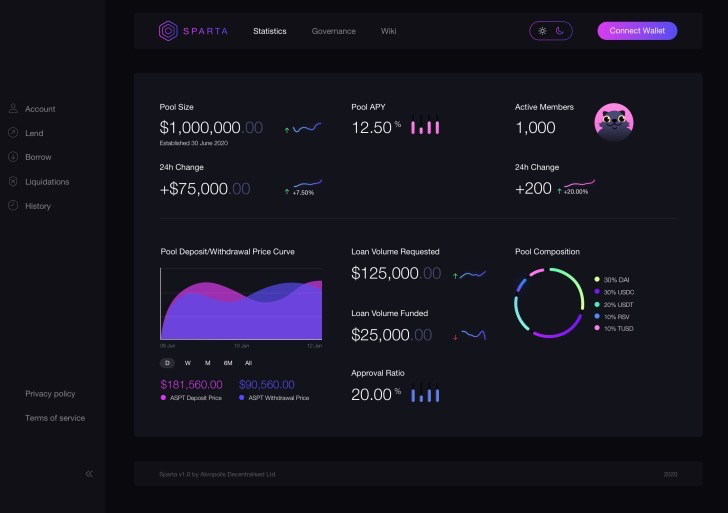

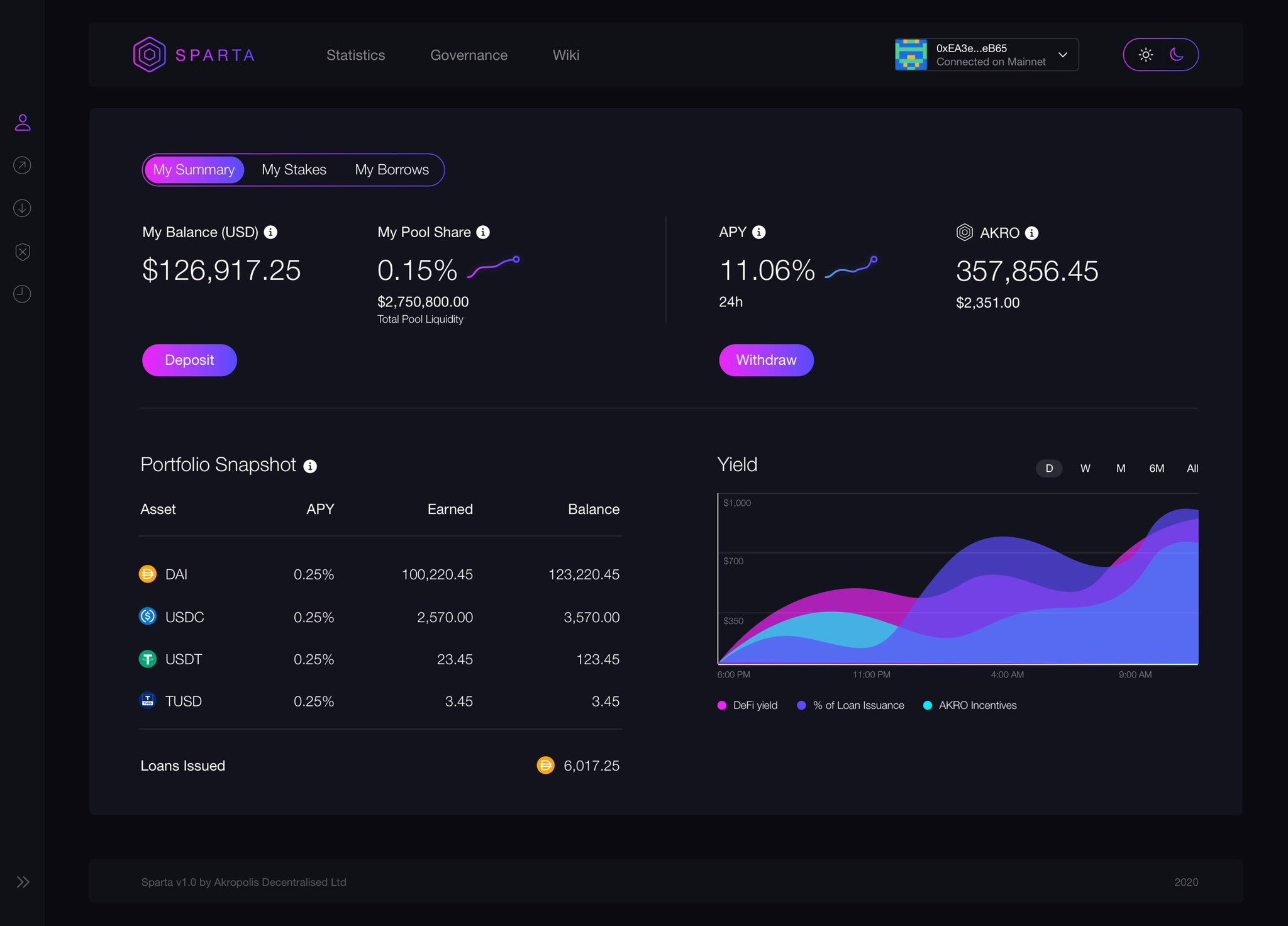

The Akropolis team announced on Jul 01 that its DeFi aggregation and automation focused Akropolis Protocol has gone live on the Ethereum blockchain. The Akropolis Protocol itself refers to a easy-to-use suite of borderless, trust minimized, portable and fraud resistant DeFi products, for financial operations and decision making. It was developed after extensive research and development. The principal component is the AkropolisOS, on which the other two undercollateralized loan focused Sparta and automated passive mixed investing/income product focused Delphi are built on.

The AkropolisOS completed a full security audit by the Certik team and Akropolis team will further run a bug bounty in the future. The Akropolis Protocol will provide DeFi equivalents of core financial services of insurable savings (variable and fixed rate savings deposits) and access to credit on relaxed terms. The platform has integrations with Compound, Fulcrum, Aave, Maker, Curve and dYdX. The native token is AKRO used for governance, platform usage and reward distribution, with a total supply of 4 billion AKRO, out of which 1.3 billion AKRO are currently in circulation. It will be released in full by 2022.

Akropolis Protocol – AkropolisOS

AkropolisOS is a developer focused DeFi framework built with OpenZeppelin SDK and based on Facade software design pattern. It is designed to be expressive, modular and upgradeable. With its secure scalable architecture, it enables the design and deployment of Decentralized Autonomous Organizations (DAO) with customizable incentives, programmable automated liquidity provision and treasury management.

Akropolis Protocol – Future Updates

The Akropolis Protocol is being actively developed and plans to introduce powerful features in the future. It will offer seamless crypto/fiat on-off ramp, support for USDT/USDC/RSV stablecoins and UI/EX enhancements. Chief amongst all, however would be the liquidity mining incentives feature, meaning that the pool governance token AKRO will be proportionally distributed to the liquidity providers, for contributing to pool and providing loan sum to lenders/borrowers. The team has allocated 20% of the total AKRO supply for liquidity mining incentives.

The team is also developing a DeFi yield re-balancing module to provide additional passive income to the users through Robo Advisor for re-balancing between protocols (Aave, Fulcrum, Compound, dYdX) for yield and Curve.fi for stablecoins re-balancing for higher APR. The users will also be able to pay the transaction fees in the token they are transacting in, instead of having to convert to or keep ETH , through integrations with OpenGSN.

To decentralize the protocol, a governance protocol is being set up, where the AKRO token holders community will be able to vote on protocols parameters. The Akropolis team will also get the insurance coverage from Nexus Mutual/Opyn to safeguard against hacks and code exploits. The proposed deployment time-frame for most of these features is Aug 2020.

In order to support and motivate the CryptoTicker team, especially in times of Corona, to continue to deliver good content, we would like to ask you to donate a small amount. Independent journalism can only survive if we stick together as a society. Thank you

Nexo – Your Crypto Banking Account

Instant Crypto Credit Lines™ from only 5.9% APR. Earn up to 8% interest per year on your Stablecoins, USD, EUR & GBP. $100 million custodial insurance.

Ad

This post may contain promotional links that help us fund the site. When you click on the links, we receive a commission – but the prices do not change for you! 🙂

Disclaimer: The authors of this website may have invested in crypto currencies themselves. They are not financial advisors and only express their opinions. Anyone considering investing in crypto currencies should be well informed about these high-risk assets.

Trading with financial products, especially with CFDs involves a high level of risk and is therefore not suitable for security-conscious investors. CFDs are complex instruments and carry a high risk of losing money quickly through leverage. Be aware that most private Investors lose money, if they decide to trade CFDs. Any type of trading and speculation in financial products that can produce an unusually high return is also associated with increased risk to lose money. Note that past gains are no guarantee of positive results in the future.

You might also like