Bitcoin remains in its quite familiar range between $9,000 and $9,300 after a 2% increase from yesterday’s low.

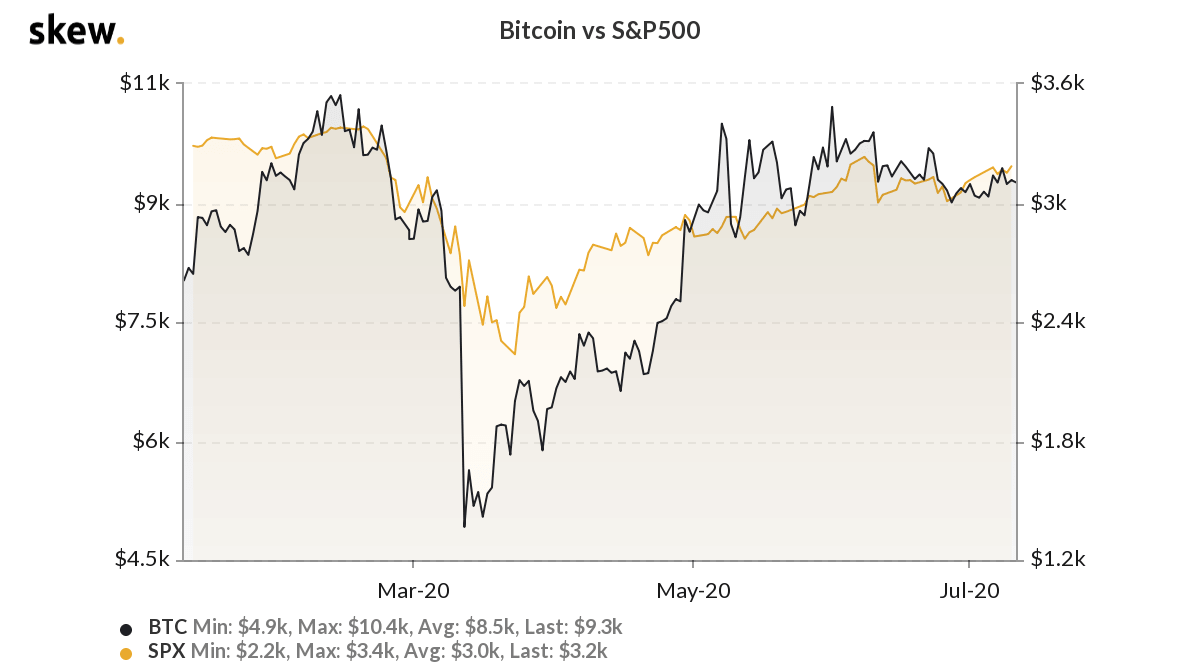

The most prominent US-based indexes registered similar increases yesterday, confirming the high correlation levels between the two asset groups.

Bitcoin And Altcoins Recover

As reported yesterday, the price for the primary cryptocurrency decreased to $9,050 on some exchanges like Bitstamp. On its way down, Bitcoin broke below the $9,300 level. The significant support at $9,000 confined the losses.

During the past 24 hours, the bulls took charge and pushed BTC towards that critical $9,300 level again. Their efforts didn’t come to fruition and it currently trades at aorund $9,250.

Several alternative coins are registering substantial price increases. As a result, Bitcoin’s dominance decreased by 2% in eight days.

Following the news of Swingby’s integration, Elrond is still the most impressive performer among the top 100 coins. With over 50% daily gains, ERD is trading at $0,012. Just a month ago, it struggled beneath $0,003, meaning that in 30 days, the asset pumped by 300%.

Cosmos and Algorand are up by about 20% to $4,43, and $0.28, respectively. Other impressive gainers include Aave (17%), Stratis (16.9%), and Stellar (11.43%).

From the top 20 altcoins, Binance Coin increases by 5% to $17.38. Tezos, after a few days of adverse price developments, is up by 6%, and XTZ is trading at $2.6.

Legacy Markets Lead The Charge

The correlation between Bitcoin and the stock market indexes was evident yesterday as well, as the S&P 500, the Dow Jones, and Nasdaq were all up by approximately 1-1.5%. Data from the monitoring company Skew reveals that the S&P 500 and the primary cryptocurrency have performed quite similarly during the past six months, and especially following the COVID-19 crisis.

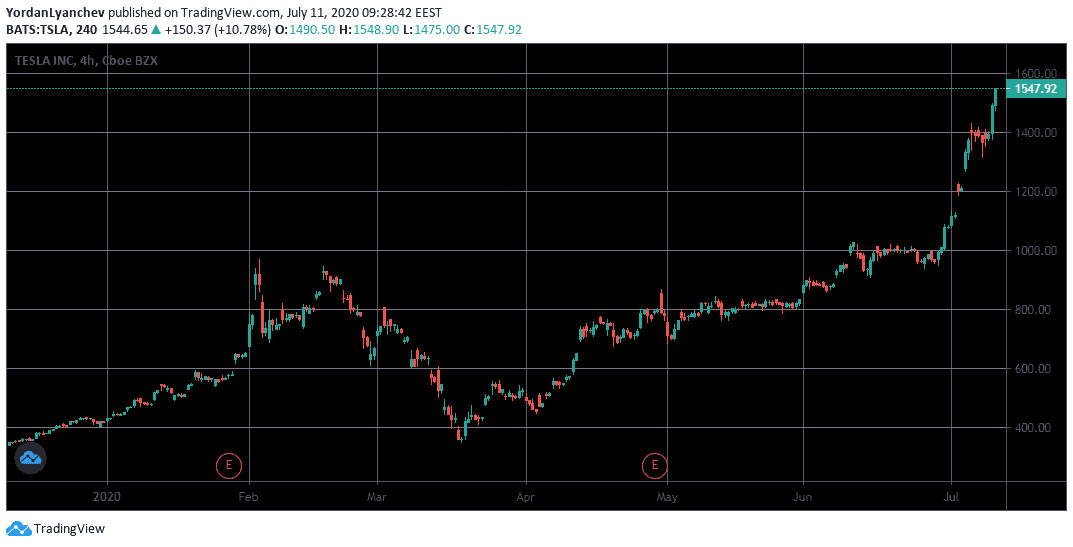

Interestingly, the prominent index could soon have a new member of its 500 elite US-listed company stocks, according to Reuters. After being arguably among the best-performing equities in the past year with a surge of 500%, Tesla (TSLA) is on the verge of joining the S&P 500.

The latest speculations came after Tesla announced Q2 vehicle deliveries exceeding the expectations last week. The company stock reacted with another massive surge, and TSLA closed Friday’s session at a new all-time high level of about $1,550.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Cryptocurrency charts by TradingView.