Source: Aedka Studio – Shutterstock

- Within the last 24 hours, the Bitcoin price moved between $9,000 and $9,200 and could not break out of the sideways trend.

- Analysts expect a strong price movement in the coming days, which could lead to a 20% correction.

- Grayscale’s interest in Bitcoin remains strong, with the institution purchasing more Bitcoin than is currently mined.

Bitcoin is currently in a consolidation phase. For several days the Bitcoin price has been moving between $9,000 and $9,300 and does not show a clear trend. The short-term volatility continues to decrease, while analysts are waiting for a clear movement. In the last 24 hours, Bitcoin has achieved a slight plus of 0.17%. The current Bitcoin price is $9,139.59. The market capitalization is currently at $168,47 billion

The trader HornHairs describes in a tweet that the volatility of the BTC price continues to decrease. He points out that this consolidation phase will probably be followed by a strong price correction soon:

Do not be surprised to see a single daily candle expand 20% in either direction to resolve this range and period of low volatility.

Blockroot founder and Bitcoin trader Josh Rager is also watching the current developments closely and states that the further decrease in volatility will continue until the end of the week:

This $BTC compression could go on for days. Slowly making into a smaller and smaller range. Quite sure it’s going to be boring until at least weekly close. You can either trade altcoins or go out and enjoy the outdoors.

Source: https://twitter.com/Josh_Rager/status/1284182167099265024/photo/1

The altcoin market has also calmed down after the last major volatility period. The top winners of the last 24 hours include Kyber Network (KNC) with a plus of 16.33% to a price of $1.83 and Dogecoin (DOGE) with a plus of 14.09% to a price of $0.0034.

Among the biggest losers are Chainlink (LINK), down 4.95% to $7.95 and Algorand (ALGO) down 4.08% to $0.338 at the time of writing. Ethereum (ETH) is also moving sideways and recorded a slight increase of 0.23 % to a price of $233.19 within the last 24 hours.

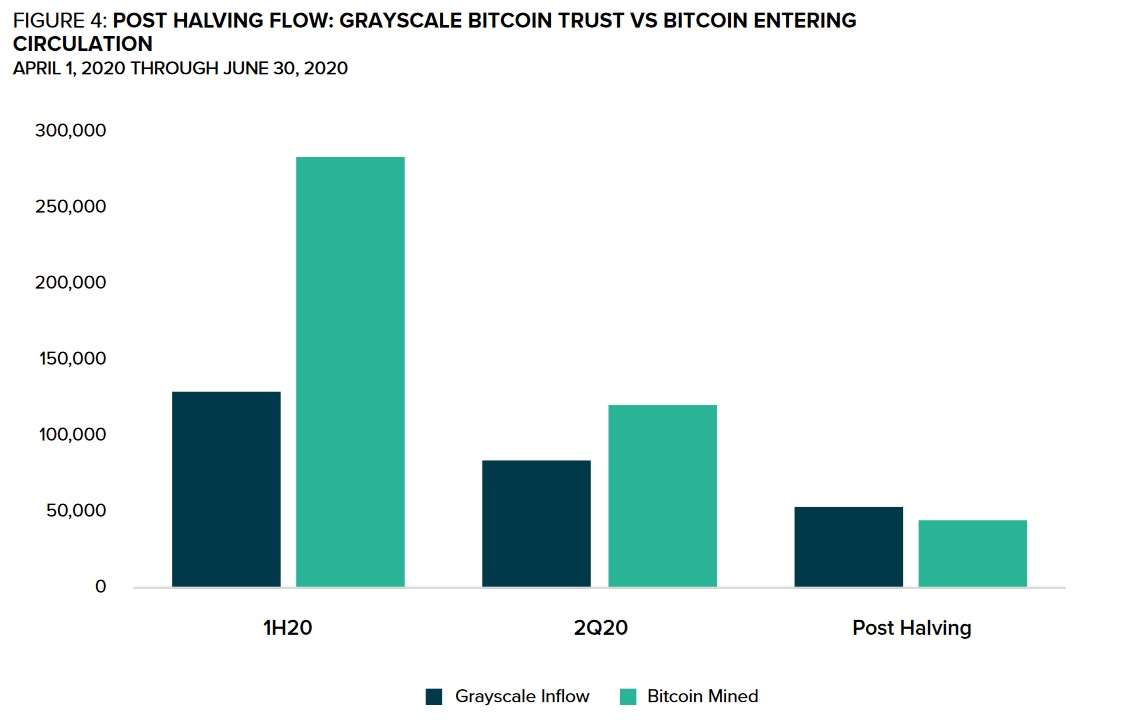

BTC-Trust from Grayscale: Customers buy Bitcoin faster than new BTCs are mined

According to current data from the quarterly and semi-annual reports of the major investor Grayscale, customer interest in Grayscale’s Bitcoin investment funds continues to grow steadily. According to Grayscale, the purchase rate of its Bitcoin products has now exceeded the mining rate of Bitcoin:

After Bitcoin’s halving in May, 2Q20 inflows into Grayscale Bitcoin Trust surpassed the number of newly-mined Bitcoin over the same period.

The following chart shows the volume of purchased Bitcoins from Grayscale’s Bitcoin Trust in direct comparison to the number of mined Bitcoins. After the halving, Grayscale has bought more Bitcoins to date than were newly produced in the same period.

Source: https://grayscale.co/wp-content/uploads/2020/07/Grayscale-Digital-Asset-Investment-Report-Q2-2020.pdf

This development shows that the interest of institutional investors in Bitcoin continues to grow and this could have a positive impact on Bitcoin.

Last updated on