In summary:

- Coinmarketcap has followed through on its promise to rank Bitcoin derivatives markets on a separate page.

- Huobi, Binance and Bitmex are in the top 3 positions respectively.

- ByBit and OKEx come in fourth and fifth.

- The 24-hour volume of the Bitcoin derivatives markets indicate that leveraged trading is becoming more popular.

- Bitcoin derivatives traders could be risking more than they can afford.

A quick look at Coinmarketcap.com reveals that the rankings website has gone through a metamorphosis in terms of the data it provides to crypto traders and investors. Clicking on the drop-down menu on the left of the page reveals a list of new categories of rankings. The screenshot below provides a better illustration of the new choices on Coinmarketcap.

Huobi, Binance and Bitmex are the Top 3 in Bitcoin Derivatives Markets

Clicking on the derivatives category reveals that Coinmarketcap has followed through on its promise to rank the BTC Perpetual swaps markets separately from the spot markets. Back in early June, as the changes were ongoing, the popular derivatives platforms of Bitmex, Bybit and Deribit were ranked 175th, 177th and 179th respectively. These rankings confused traders before Coinmarketcap revealed they were separating the derivatives markets from spot markets.

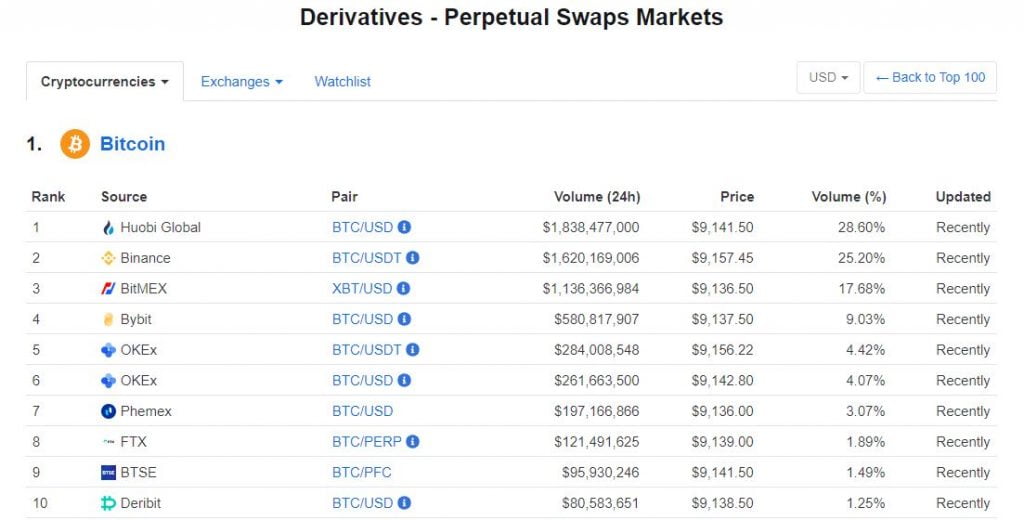

From the new derivatives rankings (screenshot below), it can be observed that the top 5 spots are occupied by Huobi, Binance, Bitmex, ByBit and OKEx respectively. Deribit is now ranked 10th in the new rankings.

Leveraged Trading of Bitcoin has Become Popular

A quick addition of the 24-hour trade volume of the top 5 Bitcoin derivatives markets reveals that $5.5 Billion worth of Bitcoin perpetual contracts have been traded on the last day. On the other hand, the 24-hour volume of the Bitcoin spot market is valued at $15.959 Billion. This means that the volume of the Bitcoin derivatives markets is slowly catching up to that of the spot markets pointing to an increased number of traders preferring Bitcoin perpetual contracts.

Bitcoin Derivatives Traders Could Be Risking More Than They Can Afford to Lose

The latter theory is in line with an earlier observation of low exchange reserves of Bitcoin that pointed to traders preferring to use leveraged trading by utilizing lower BTC balances. Evidence of this trend was highlighted in a June 24th tweet by the team at Glassnode who concluded that the Bitcoin balances on exchanges was at a one year low of 2.624 Million BTC.

📉 #Bitcoin $BTC Balance on Exchanges just reached a 1-year low of 2,624,543.178 BTC

Previous 1-year low of 2,625,311.729 BTC was observed on 19 June 2020

View metric:https://t.co/9vOOAmwh32 pic.twitter.com/xCRBx4d5F0

— glassnode alerts (@glassnodealerts) June 24, 2020

The accompanying chart from the tweet indicates that traders prefer to keep a fraction of their Bitcoin holdings in exchanges to fund their leveraged trading. Furthermore, it could point to another worrying possibility that some traders are overleveraged. This increases their probability of getting rekt via liquidations.

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of EWN or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.