U.S. crypto exchanges made an estimated $1 billion in trading fee revenue in 2019 and are poised for … [+]

Crypto is a disruptive technology designed to be an alternative to the fiat monetary system and fundamentally challenge countless industries. Over the next decade, the space will compete with incumbent financial services and banking institutions and crypto exchanges are poised to capture the growth.

Historically, exchanges have served as the primary access point introducing users to crypto and enabling them to engage with a variety of crypto assets. Crypto started as a retail phenomenon marking the first time retail investors were able to access a new asset class prior to institutional investors. Thus, retail focused crypto exchanges positioned themselves to serve retail demand. In just 8 years, Coinbase propelled crypto to the mainstream serving over 30 million users and other exchanges followed suit as crypto entered the public consciousness.

The internet is often touted as the closest analogy to the emergence of crypto and blockchain technology. The internet was a fundamentally disruptive and paradigm shifting technology, forever changing the way users interact, communicate, and conduct commerce. Crypto very well may exhibit similar societal change, and thus its growth trend may mimic that of the internet. User adoption of the internet achieved hockey stick growth, and it reached 10% of American households in 1995, five years after the first web browser was launched. User adoption reached 50% in the U.S. by the year 2000.

Reports vary and user adoption of crypto in the U.S. is currently reported to be approximately 5%. Although Bitcoin is 11 years old and has come a long way, it has yet to see hockey stick growth in terms of user adoption. Bitcoin is currently working through issues of scalability, privacy, and ease of use, which are all things the internet had to overcome in order to reach maturity. Assuming Bitcoin’s growth story follows that of the internet, Bitcoin is positioned to achieve user adoption between 20-50% by the year 2030.

To project future exchange growth in the U.S., I assumed 5% user adoption of crypto in the US currently and calculated revenue growth if user adoption reaches 10% (conservative case), 20% (base case), and 50% (optimistic case) in the year 2029.

Using Messari’s “Real 10” exchange volume data set, the aggregate exchange volume of US trading activity in 2019 was over $227 billion. Growing from $1.3 billion in estimated exchange volume in 2015, this increase represents a compounded annual growth rate (CAGR) of 15.7% per year.

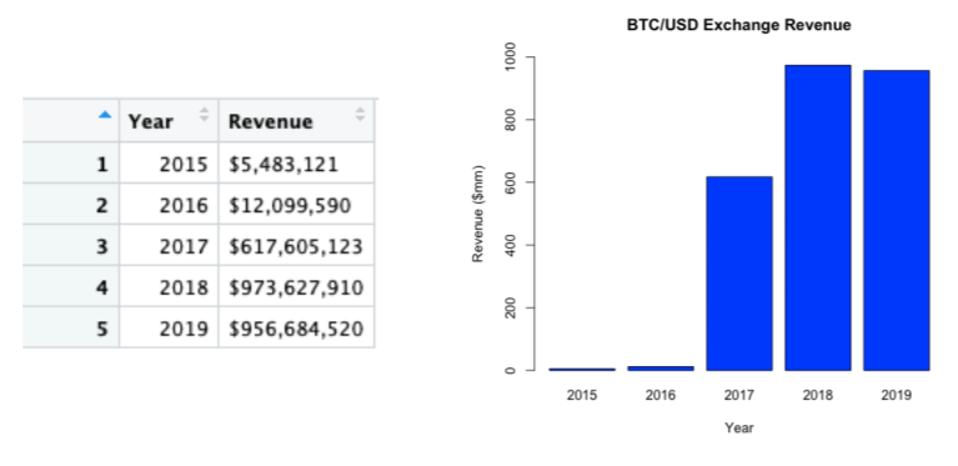

Estimated BTC/USD exchange volume for the years 2015-2019.

Further, assuming the average trading fee was 0.42% (using Kraken’s fee schedule, 16 basis points for maker and 26 basis points for taker), aggregate exchange revenue from trading fees was approximately $956 million in 2019.

Estimated BTC/USD trading fee exchange revenue for the years 2015-2019.

Now, taking the assumption that crypto adoption is currently 5% in the U.S., we can estimate the future projected exchange revenue across the three scenarios of adoption in 2029 (10%, 20%, and 50% adoption). When doing so, the resulting exchange revenues in 2029 for each scenario are $1.9 billion in the conservative case, $3.8 billion in the base case, and $9.6 billion in the optimistic case. Assuming linear growth, the exchange revenues per year are shown below.

Projected BTC/USD trading fee exchange revenue for the years 2020-2029 estimated for three adoption … [+]

Since the launch of the first web browser in 1990, the internet took just seven years to reach 20% user adoption in the U.S. The exchange revenue base case explored above assumes the same user penetration of 20% would be reached 19 years after the launch of the first mainstream Bitcoin exchange, Mt. Gox. Considering the explosive growth of crypto networks and the acceleration of technology writ large, this assumption may serve as a lower bound of user adoption.

Furthermore, this analysis only includes Bitcoin spot trading revenue and does not factor in other sources of exchange revenue such as trading fees from other cryptoassets, derivatives/futures trading, staking, asset withdrawal/deposit fees, net interest margin, asset lending, etc.

Although the 50% user adoption optimistic scenario may seem far-fetched, there are indicators pointing to the possibility. Compared to the institutional crypto market, retail users have been much quicker to adopt crypto and more eager to gain exposure. Bitcoin reached its all-time high of ~$20,000 in December 2017 with virtually zero institutional participation, as retail investors sought to front run the first institutional-grade cash-settled Bitcoin futures markets (CME & CBOE).

As of mid-2019, Binance Research estimated just 7% of crypto assets are held by institutional investors. Furthermore, Bitwise’s financial advisor survey estimated 6% of financial advisors were allocating crypto to their clients’ portfolios, which is expected to double to 13% in 2020. Despite retail participants acting as the primary driver of the crypto markets, only 5% of the total U.S. population own or use crypto currently. Although institutionalization of the space is happening, there is still ample growth potential amongst retail, which has served as the core user base to date.

Over the next ten years, we may see the most growth in the demographic of people currently between the ages 18-39 and living in cities/suburbs (excluding rural areas). This cohort is familiar with digital technologies and virtual goods. According to this report by Schwab the Grayscale Bitcoin Trust is already the fifth largest holding amongst Millennials, greater than Disney, Netflix

To date, retail-focused crypto exchanges have fueled the growth of the crypto market to reach its current market size of $270 billion. Although institutional investors are poised to enter the market, retail investors and users will continue to serve as its foundation. As new use cases and killer apps emerge, retail users will flood the market and exchanges are poised to capture this growth.