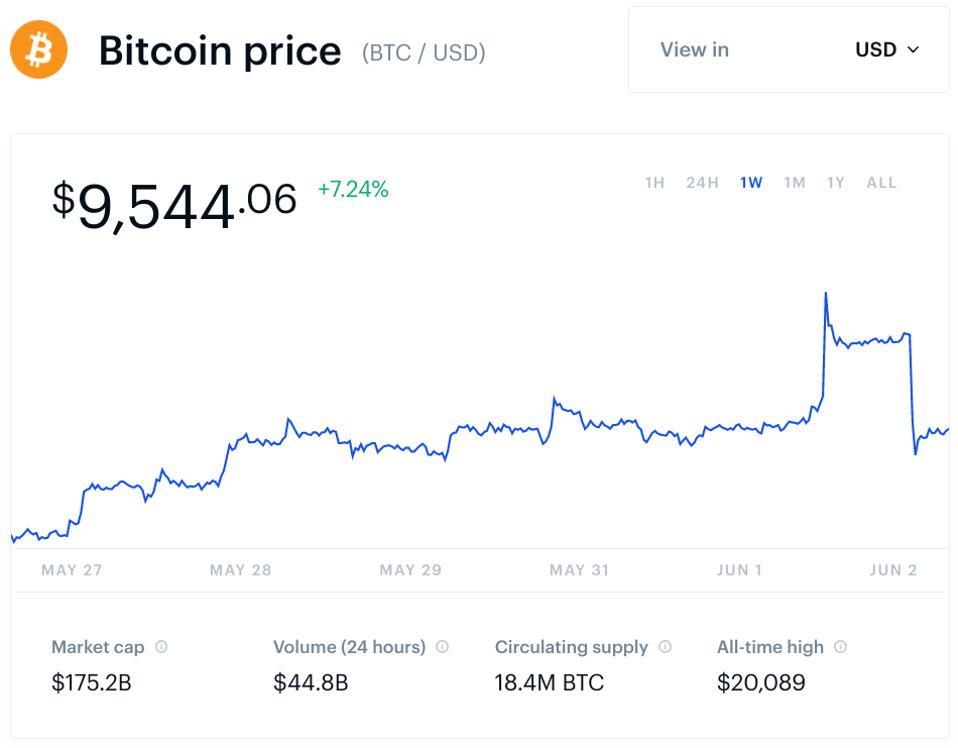

Bitcoin investors yesterday cheered the bitcoin price soaring over $10,000 per bitcoin (again)—though their celebrations were short lived.

The bitcoin price, after a number of recent runs at the psychological $10,000 level, surged to highs of $10,430 on the Luxembourg-based Bitstamp exchange on Monday evening only to crash back less than 24 hours later.

However, users of major U.S. bitcoin and cryptocurrency exchange Coinbase were left on the sidelines of the virtual trading floor after the exchange crashed offline just as the bitcoin price began to climb—and not for the first time.

Bitcoin and cryptocurrency exchange Coinbase has developed a reputation for falling offline every … [+]

“We are currently experiencing intermittent downtime,” Coinbase told users just as the bitcoin price leaped over $10,000—reporting it was “back up and running” under an hour later.

The importance of Coinbase, by far the largest U.S. crypto exchange, to the bitcoin and cryptocurrency ecosystem shouldn’t be underestimated.

As well as being one of the most common ways Americans are introduced to bitcoin and crypto, Coinbase is the largest bitcoin holder among exchanges with almost 1 million bitcoin—more than double Singapore-based Huobi and three times more than Malta-based Binance, according to recent research carried out by The Block, a crypto news and analysis site.

However, Coinbase users have become accustomed to the San Francisco-based exchange dropping offline during sudden moves in the bitcoin price—with the site unreachable four times in as many months since March.

“How does an exchange with an $8 billion valuation crash every time bitcoin pumps 5%,” Dan Gambardello, the chief executive of recruiting firm Crypto Capital Venture, asked via Twitter.

“It’s worth noting that none of these outages lasted for longer than 45 minutes and it’s very unlikely that any single customer would have been unable to trade for this entire time,” a Coinbase spokesperson said.

“Our APIs were still accessible and the underlying market was healthy for the entire time.”

Last month, a Coinbase outage locked users out of their bitcoin and crypto accounts also just as the bitcoin price was bouncing around $10,000.

Before that, Coinbase went down in March, leaving users locked out of their accounts during the coronavirus market crash that wiped more than 20% from bitcoin’s value in mere minutes.

Users reported at least two similar issues over the course of 2019.

The raft of Coinbase outages has prompted some in the bitcoin and cryptocurrency community to warn against using the exchange.

“Crypto prices rise and once again Coinbase shows error messages to people trying to access funds,” said one Twitter user. “I would highly suggest when you get in, get those funds off that exchange.”

“How many times do we have to say take your bitcoin off of Coinbase if you want to have access to it,” Rachel Siegel, a bitcoin and cryptocurrency content creator, warned last time Coinbase buckled under pressure, adding, “this is not the first time Coinbase has gone down and it surely will not be the last.”

The bitcoin price leaped over $10,000 per bitcoin only to give up its gains almost instantly.

Bitcoin’s latest assault on $10,000 comes after a number of cryptocurrency investors called the beginning of a “fourth crypto cycle.”

“The 2017 cycle spawned dozens of exciting projects in a wide range of areas including payments, finance, games, infrastructure, and web apps,” venture capital firm Andreessen Horowitz partners Chris Dixon and Eddy Lazzarin wrote in a blog post last month.

“Many of these projects are launching in the near future, possibly driving a fourth crypto cycle.”

Meanwhile, one of the most closely-watched bitcoin analysts, an anonymous strategist who claims to be a member of an institutional investment team that manages around $100 billion in assets, has released an update to his so-called stock-to-flow model, suggesting the bitcoin price could be about to surge to around $100,000.