N Rotteveel

The following segment was excerpted from this fund letter.

Coinbase (NASDAQ:COIN)

The crypto ecosystem moves extremely quickly, and there’s been many new developments since we first invested in Coinbase, a year ago.

Most notably, crypto market cap has declined from a peak of ~$3 Trillion last fall, to ~$1.1 Trillion today (a -63% decline, and -72% peak-to-trough). Crypto is a volatile asset class, and has experienced many draw-downs of similar magnitude in the past. For example, Bitcoin was down -93% during 2011, -85% from 2013-15, and -84% from 2017-18. In this context, the latest draw-down is a pretty normal outcome for this emerging asset class.

A large reason for this volatility, is simply because there aren’t any major “real-world use cases” for the asset just yet. In our letter outlining the investment last year, we wrote that crypto is still “in the middle of ‘crossing the chasm’ into mainstream adoption & use cases, which will result in millions of mainstream users needing to transact crypto in some form”

This adoption is progressing, and there are a variety of applications that have shown real utility over the past year. However, since it’s still early days, the bulk of crypto trading is still conducted for speculation, instead of utility. This will undoubtedly shift over time, as the crypto ecosystem continues to develop more utility over the coming years.

But in the meantime, this means that when bear-markets hit, retail interest in trading crypto dies down, since there’s no daily use case for crypto just yet. The only source of demand for crypto (i.e. speculation) dries up, leading to prices falling as a result.

Until crypto “crosses the chasm” into mainstream adoption and daily utility, Coinbase’s business model will remain volatile – and even more so than its competitors.

Lately, there have been headlines speculating on Coinbase’s demise, most of which cite Coinbase’s declining market share relative to other exchanges. However this is an extremely inaccurate comparison, since we’d argue that Coinbase is in a very different end market, than global exchanges which cater predominantly to institutions, and also lie outside of US regulations (or any country’s regulations, for that matter).

Competitors such as FTX or Binance derive the bulk of their business from institutions / cryptonative “whales”, while Coinbase derives ~77% of its revenues from retail users that only trade a few hundred dollars at a time.[1] These institutions are in the business of trading crypto, so they will continue to trade regardless of the market environment. Meanwhile, retail users are far more finicky, and will trade / speculate when prices are rising, and lose interest when prices are declining.

“We have about four times [Coinbase’s] daily trading volume [on a global level] and about 3% of their user base.

So it’s a factor of 100 difference in volume per user. They [Coinbase] have done spectacularly at the long tail retail consumer, and we have done much better at the more sophisticated, more highly engaged users who trade larger volume each.” – Sam Bankman-Fried, Founder of FTX

These institutions and whales tend to trade on offshore exchanges, away from US regulations, since they can access a wider variety of products and leverage. Thus as a benchmark of Coinbase’s competitive position, it’s a much fairer comparison to judge it versus other US-based exchanges, such as Kraken, FTX US, Binance US, or Gemini[2]. For further information on this misperception, we discussed this dynamic in our original Coinbase memo last year[3].

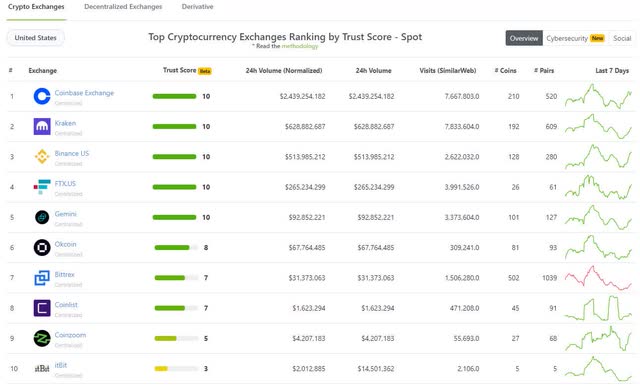

On this metric, we can see that Coinbase is still by far the leading exchange. For example, according to CoinGecko, Coinbase is currently doing ~$2.4BN in daily volume, versus Kraken at just ~$600M, Binance US at ~$500M, and FTX US at ~$260M.

US Crypto Exchange Market Share (Source: CoinGecko (LINK); Screenshot as of August 15, 2022)

We also showed a similar snapshot last year. If you compare that September 20, 2021 snapshot to the one above (see pg. 29), you’ll see that Coinbase has actually done a great job of maintaining its market share during this bear market.

It’s still ~4x larger than the next largest competitor, and also ~1.6x larger than the next 4 competitors combined. Thus even though the total “pie” (i.e. crypto trading volumes) has shrunk, Coinbase has actually maintained its relative size of that pie. It’s certainly not losing its competitive position, as media headlines would have you believe.

In the meantime, Coinbase has been using this time to improve its products and simplify the user experience, in preparation for the next phase of mainstream adoption. For example, Coinbase Wallet was just redesigned this quarter, and now supports seven different blockchains, so more crypto assets can be held all within one account. Compare this to its primary competitor – Metamask – which still doesn’t support Solana, and users still need to have a separate wallet for those assets.

We’ve invested in Coinbase, based upon the thesis that eventually crypto will be used for daily transactions – and it’s hard for us to imagine a world, where everyday consumers will want to switch back and forth between multiple wallets, when they can use Coinbase as a one-stop-shop.

Considering historical technology adoption has shown that mainstream users care most about simplicity and ease-of-use, this development puts Coinbase on track to eventually become the de facto crypto wallet used for daily transactions.

On top of this, we were encouraged to see that Coinbase managed to avoid the entire debacle around the Three Arrows Capital blowup. Three Arrows (or “3AC”, as it’s known) was one of the largest hedge funds in the crypto space.

In June, the firm started facing liquidity issues, as crypto prices fell and it found itself over extended on leverage. With over $10BN in assets at its peak, the firm’s collapse managed to take down several notable brokers and lenders who provided 3AC with loans, including the bankruptcy of Voyager Digital and Celsius, resulting in a “mini-Lehman Brothers” type event for the space. Coinbase meanwhile avoided this debacle, which we believe is another indication of its conservative culture (whether in launching new products, lending, dealing with regulators, etc.).

We believe that over the long-run, this type of behavior will only build trust with customers and stakeholders alike, which is vitally important for a firm that seeks to safe-keep the assets of hundreds of millions of individuals and institutions.

While all this was going on, Coinbase’s share price reached an astonishing ~$8BN valuation ($11BN market cap – $3BN of net cash). The company earned $3.6BN in net income last year, so shares were priced at just ~2.2x P/E (2021), for a company that is just getting started in this emerging field[4].

Obviously, the financial results of Coinbase will be volatile, while transactions are still primarily used for speculation. We see the company as essentially a tax on the crypto ecosystem, based upon its dominant market position as a fiat-on ramp & US exchange. The size of that ecosystem will ebb & flow, and is largely out of Coinbase’s control. In good years the company will make several billion in profits, and in bear markets (like today) the company is guiding to a -$500M loss.

Early in the quarter, it became clear that the crypto market would soon follow the broader equity markets into a bear market. And given the reflexivity in Coinbase’s business model, we felt it was prudent to cut a significant portion of the position. We sold these shares ~$150. During the subsequent draw-down, we started to build this position back up as the aforementioned valuation became too cheap to pass up. While we missed the absolute lows, we did manage to re-build the position at a >50% discount to where we previously sold it.

It’s still a relatively small position in our portfolio, given the nascent stage & inherent risk of the industry. However, we’re excited to watch this business develop over the next decade. If we’re correct in the trajectory of the crypto industry and Coinbase’s position within it, they could very well end up being one of the most important companies of the next decade.

Footnotes

|

[1] “Whales” refer to wealthy individual traders, who trade in large sums. [2] FTX US and Binance US are subsidiaries of FTX and Binance, respectively. Since these entities operate under US regulations, they aren’t able to offer the same variety of crypto assets or products as their parent companies. [3] Please see page 27, under the “Exploring Coinbase’s Market Share (And Why We Differ From The Street)” section. [4] Although admittedly, last year was a very good year for the crypto markets, so investors shouldn’t expect these earnings on a normal basis. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.