Shares of Coinbase Global Inc. surged Tuesday, after J.P. Morgan analyst Kenneth Worthington recommended investors buy, saying the company occupies a “key position” in the U.S. market for cryptocurrency transactions, a technology which is expected to become more embedded in financial markets.

Worthington initiated coverage of Coinbase with an overweight rating and a stock price target of $371, which is about 55% above current levels.

The stock

COIN,

climbed 6.4% in afternoon trading. It is still on track to close below the $250 reference price, when it went public last month, for the seventh straight session.

The stock’s rally comes in the face bitcoin’s

BTCUSD,

2.0% decline on Tuesday.

“We see the cryptomarkets as durable and growing, and expect Coinbase has the opportunity to influence and benefit from this market growth as it innovates,” Worthington wrote in a note to clients.

He believes the crypto trading platform will be able to leverage its brand as a “trusted, secure and easy-to-use exchange” to grow its user base by converting the “interested” to the “active” user.

“With 56 million verified users, we see Coinbase driving growth by implementing a marketing program to attract more mainstream investors and to convert verified users into funded active accounts,” Worthington wrote.

Worthington’s bullish view on Coinbase puts him in the majority on Wall Street, as 12 of the 16 analysts surveyed by FactSet have the equivalent of buy ratings on the stock. The other four have the equivalent of hold ratings. The average price target is $394.

FactSet

Also read: Coinbase’s stock bounces after bullish calls from Wall Street analysts.

Read more: Buy Coinbase stock, as crypto has reached an ‘inflection point to legitimacy,’ analyst says.

Worthington’s bullish view is based on the belief that while the cryptoeconomy may be in the early stages of its lifecycle, the technology is gaining trust as a store of value.

“Cryptocurrencies are gaining interest of investors, building trust as demonstrated by the growing numbers of retail/institutions invested, and supplementing existing ownership of gold and fiat currencies,” Worthington wrote. “While cryptocurrencies lack the history of other stores, they improve on certain flaws/risks inherent in other traditional stores of value.”

Worthington’s employer, J.P. Morgan Chase & Co.

JPM,

is reportedly one of the institutions that is starting to embrace cryptocurrencies, as the banking giant will be offering its wealthy clients access to an actively managed bitcoin fund by the summer, according to a recent CoinDesk report.

That would mark an evolution in the stance taken by Chief Executive Jamie Dimon, who in 2017 called bitcoin a “fraud,” saying it will “eventually blow up.” Dimon has since toned down his criticisms of bitcoin.

FactSet, MarketWatch

Although Worthington isn’t convinced that cryptocurrencies will evolve into actual currencies used to transact business in the near- to intermediate-term, he expects cryptocurrencies to gain popularity as stores of value.

“[C]ryptocurrencies are durable, portable, fungible, visible, scarce, verifiable and free from censorship,” Worthington wrote.

There are others on Wall Street who aren’t so bullish at the moment, including Mizuho analyst Dan Dolev, who expressed concern over the outlook for bitcoin prices in the wake of the recent selloff. He affirmed his neutral rating on Coinbase on Tuesday, and slashed his price target to $225, which is 6.1% below current levels, from $315.

“Falling bitcoin prices may bring the crypto winter scenario back to the table,” Dolev wrote. “The harsh winter of 2018 resulted in volumes drying up, which adversely impacted [Coinbase’s] transacting users and retail revenues (~80% of total). Although all outcomes are still feasible for 2021, a crypto winter may mean 15%-20% potential downside to current consensus sales expectations.”

Dolev’s “harsh winter of 2018” references the 73.9% plunge in bitcoin prices that year. And while bitcoin is still up about 31% in 2021, it has tumbled 40.0% since closing at a record $63,434.45 on April 13, according to FactSet data.

Don’t miss: Why is crypto crashing? Will bitcoin prices ever recover? Here’s what traders and investors are say.

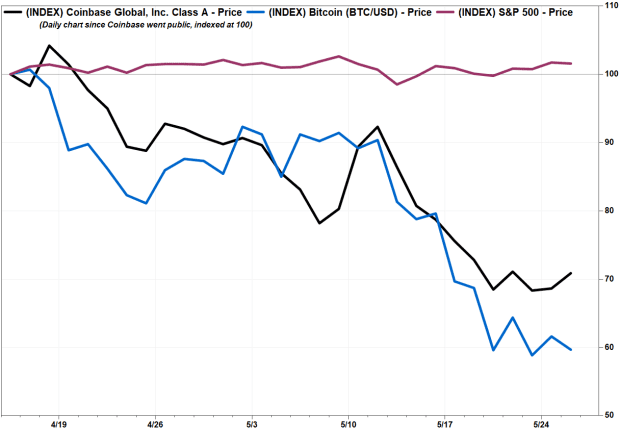

Coincidentally, bitcoin’s pullback started on the day that Coinbase went public, on April 14. Coinbase shares closed at $328.28 on its first day, or 31.3% above its reference price.

See related: Coinbase hangover? Here’s why bitcoin may be suffering its steepest slide since February.

The stock has lost 27.0% since then, while the S&P 500 index

SPX,

has gained 1.6%.