- As the cryptocurrency market continues to look confident, brief price drops are to be expected.

- Indicators show that this correction may be overdue as the dollar index approaches a strong support zone.

As demand for Bitcoin rises to record highs, the outlook becomes astonishingly bullish by the day. Nonetheless, a correction seems overdue, which will help propel prices even higher.

Bitcoin price may retest $16,000 before another leg up

The past few weeks have been eventful in the cryptocurrency market. With the massive flow of institutional investors and asset managers, the bullish thesis for Bitcoin keeps getting reinforced going into 2021. This skyrocketing demand for this new asset class has resulted in astronomical predictions on Bitcoin price in recent times.

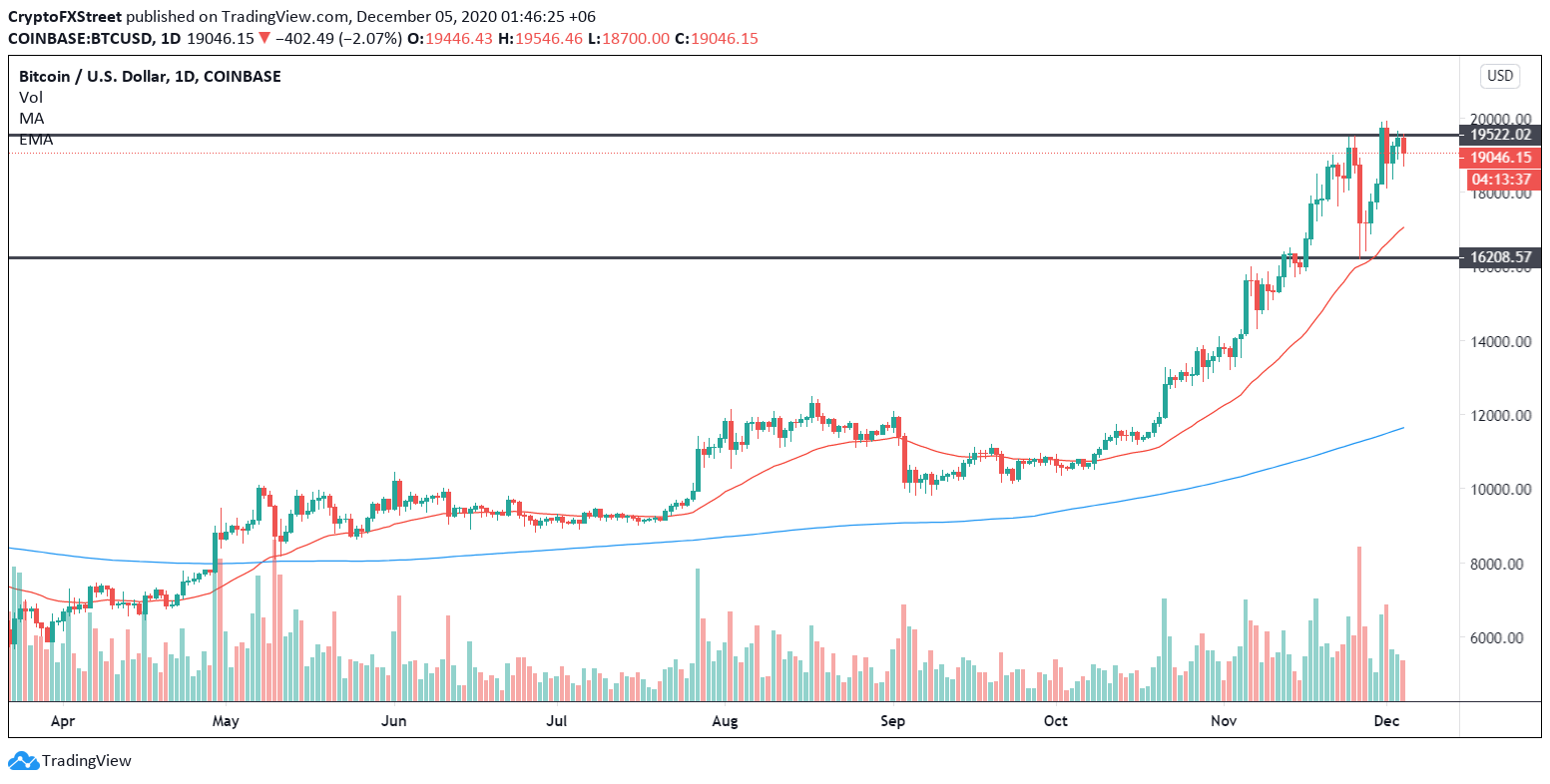

On the weekly chart, Bitcoin price is struggling to break above the $19,000 zone. Although the bulls are trying to push it to new all-time highs, this price hurdle continues to reject any upswing. As long as it continues to hold, BTC upside potential will be capped.

BTC/USD Weekly Chart

Indeed, the daily chart shows that failing to move past the $19,000 barrier will likely lead to a retracement to the next critical area of support that sits around $16,000. Such a steep correction can be perceived as healthy since it will help sidelined investors re-enter the market. Consequently, a new influx of capital may help resume the uptrend.

With sufficient buy pressure around the $16,000 hurdle, Bitcoin could establish itself here and enter a brief period of consolidation before its next leg up to $22,000.

BTC/USD Daily Chart

It is worth noting that moving past the underlying support might not be a good sign for BTC as it could serve as a confirmation for a steeper downswing towards $13,000. For this reason, investors must pay close attention to the $16,000 in the event of a correction since it will determine whether Bitcoin is poised for a rebound to new all-time highs or for more pain.